Page 21 - Capital Allowances Recoupments Part 3 (CTA)

P. 21

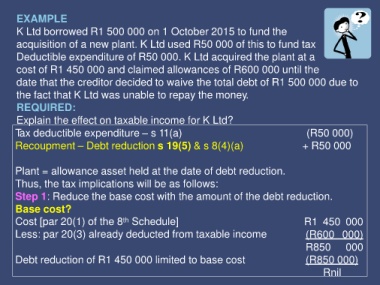

EXAMPLE

K Ltd borrowed R1 500 000 on 1 October 2015 to fund the

acquisition of a new plant. K Ltd used R50 000 of this to fund tax

Deductible expenditure of R50 000. K Ltd acquired the plant at a

cost of R1 450 000 and claimed allowances of R600 000 until the

date that the creditor decided to waive the total debt of R1 500 000 due to

the fact that K Ltd was unable to repay the money.

REQUIRED:

Explain the effect on taxable income for K Ltd?

Tax deductible expenditure – s 11(a) (R50 000)

Recoupment – Debt reduction s 19(5) & s 8(4)(a) + R50 000

Plant = allowance asset held at the date of debt reduction.

Thus, the tax implications will be as follows:

Step 1: Reduce the base cost with the amount of the debt reduction.

Base cost?

Cost [par 20(1) of the 8 Schedule] R1 450 000

th

Less: par 20(3) already deducted from taxable income (R600 000)

R850 000

Debt reduction of R1 450 000 limited to base cost (R850 000)

Rnil