Page 24 - Capital Allowances Recoupments Part 3 (CTA)

P. 24

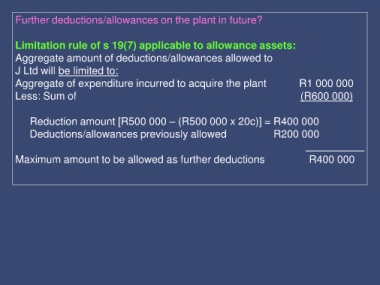

Further deductions/allowances on the plant in future?

Limitation rule of s 19(7) applicable to allowance assets:

Aggregate amount of deductions/allowances allowed to

J Ltd will be limited to:

Aggregate of expenditure incurred to acquire the plant R1 000 000

Less: Sum of (R600 000)

Reduction amount [R500 000 – (R500 000 x 20c)] = R400 000

Deductions/allowances previously allowed R200 000

Maximum amount to be allowed as further deductions R400 000