Page 19 - Capital Allowances Recoupments Part 3 (CTA)

P. 19

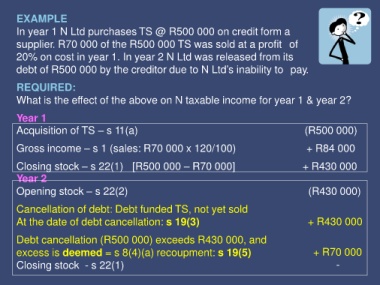

EXAMPLE

In year 1 N Ltd purchases TS @ R500 000 on credit form a

supplier. R70 000 of the R500 000 TS was sold at a profit of

20% on cost in year 1. In year 2 N Ltd was released from its

debt of R500 000 by the creditor due to N Ltd’s inability to pay.

REQUIRED:

What is the effect of the above on N taxable income for year 1 & year 2?

Year 1

Acquisition of TS – s 11(a) (R500 000)

Gross income – s 1 (sales: R70 000 x 120/100) + R84 000

Closing stock – s 22(1) [R500 000 – R70 000] + R430 000

Year 2

Opening stock – s 22(2) (R430 000)

Cancellation of debt: Debt funded TS, not yet sold

At the date of debt cancellation: s 19(3) + R430 000

Debt cancellation (R500 000) exceeds R430 000, and

excess is deemed = s 8(4)(a) recoupment: s 19(5) + R70 000

Closing stock - s 22(1) -