Page 18 - Capital Allowances Recoupments Part 3 (CTA)

P. 18

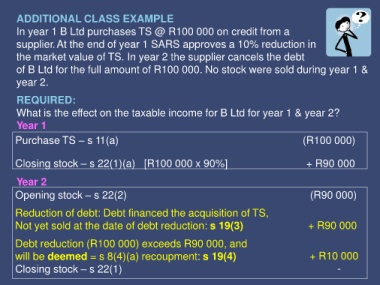

ADDITIONAL CLASS EXAMPLE

In year 1 B Ltd purchases TS @ R100 000 on credit from a

supplier.At the end of year 1 SARS approves a 10% reduction in in

the market value of TS. In year 2 the supplier cancels the debt

of B Ltd for the full amount of R100 000. No stock were sold during year 1 &

year 2.

REQUIRED:

What is the effect on the taxable income for B Ltd for year 1 & year 2?

Year 1

Purchase TS – s 11(a) (R100 000)

Closing stock – s 22(1)(a) [R100 000 x 90%] + R90 000

Year 2

Opening stock – s 22(2) (R90 000)

Reduction of debt: Debt financed the acquisition of TS,

Not yet sold at the date of debt reduction: s 19(3) + R90 000

Debt reduction (R100 000) exceeds R90 000, and

will be deemed = s 8(4)(a) recoupment: s 19(4) + R10 000

Closing stock – s 22(1) -