Page 20 - Capital Allowances Recoupments Part 3 (CTA)

P. 20

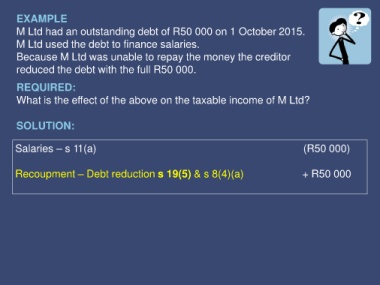

EXAMPLE

M Ltd had an outstanding debt of R50 000 on 1 October 2015.

M Ltd used the debt to finance salaries.

Because M Ltd was unable to repay the money the creditor

reduced the debt with the full R50 000.

REQUIRED:

What is the effect of the above on the taxable income of M Ltd?

SOLUTION:

Salaries – s 11(a) (R50 000)

Recoupment – Debt reduction s 19(5) & s 8(4)(a) + R50 000