Page 111 - Microsoft Word - 00 P1 IW Prelims.docx

P. 111

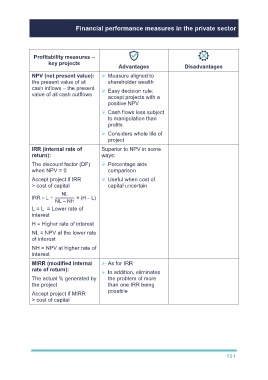

Financial performance measures in the private sector

Profitability measures –

key projects

Advantages Disadvantages

NPV (net present value): Measure aligned to Absolute figure so hard

the present value of all shareholder wealth to compare projects

cash inflows – the present Easy decision rule; Based on a number of

value of all cash outflows

accept projects with a assumptions

positive NPV

Cash flows less subject

to manipulation than

profits

Considers whole life of

project

IRR (internal rate of Superior to NPV in some Overall, less superior to

return): ways: NPV since:

The discount factor (DF) Percentage aids Possible to get more

when NPV = 0 comparison than one IRR

Accept project if IRR Useful when cost of Trickier to calculate and

> cost of capital capital uncertain understand

NL

IRR = L + × (H – L)

NL – NH

L = L = Lower rate of

interest

H = Higher rate of interest

NL = NPV at the lower rate

of interest

NH = NPV at higher rate of

interest

MIRR (modified internal As for IRR Overall, less superior to

rate of return): NPV, e.g. trickier to

In addition, eliminates

The actual % generated by the problem of more calculate and

the project than one IRR being understand

possible

Accept project if MIRR

> cost of capital

101