Page 71 - NAFIF-2019-Facility-Reference-Guide

P. 71

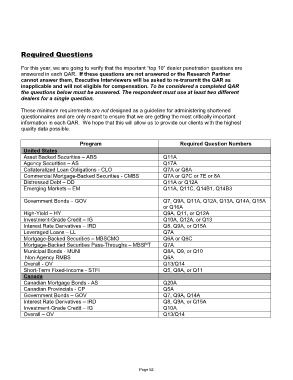

Required Questions

For this year, we are going to verify that the important “top 10” dealer penetration questions are

answered in each QAR. If these questions are not answered or the Research Partner

cannot answer them, Executive Interviewers will be asked to re-transmit the QAR as

inapplicable and will not eligible for compensation. To be considered a completed QAR

the questions below must be answered. The respondent must use at least two different

dealers for a single question.

These minimum requirements are not designed as a guideline for administering shortened

questionnaires and are only meant to ensure that we are getting the most critically important

information in each QAR. We hope that this will allow us to provide our clients with the highest

quality data possible.

Program Required Question Numbers

United States

Asset Backed Securities – ABS Q11A

Agency Securities – AS Q17A

Collateralized Loan Obligations - CLO Q7A or Q8A

Commercial Mortgage-Backed Securities - CMBS Q7A or Q7C or 7E or 8A

Distressed Debt – DD Q11A or Q12A

Emerging Markets – EM Q11A, Q11C, Q14B1, Q14B3

Government Bonds – GOV Q7, Q9A, Q11A, Q12A, Q13A, Q14A, Q15A

or Q16A

High-Yield – HY Q9A, Q11, or Q12A

Investment-Grade Credit – IG Q10A, Q12A, or Q13

Interest Rate Derivatives – IRD Q8, Q9A, or Q15A

Leveraged Loans – LL Q7A

Mortgage-Backed Securities – MBSCMO Q6A or Q6C

Mortgage-Backed Securities Pass-Throughs – MBSPT Q7A

Municipal Bonds - MUNI Q8A, Q9, or Q10

Non-Agency RMBS Q6A

Overall - OV Q13/Q14

Short-Term Fixed-Income - STFI Q5, Q8A, or Q11

Canada

Canadian Mortgage Bonds - AS Q20A

Canadian Provincials - CP Q5A

Government Bonds – GOV Q7, Q9A, Q14A

Interest Rate Derivatives – IRD Q8, Q9A, or Q15A

Investment-Grade Credit – IG Q10A

Overall – OV Q13/Q14

Page 52