Page 69 - NAFIF-2019-Facility-Reference-Guide

P. 69

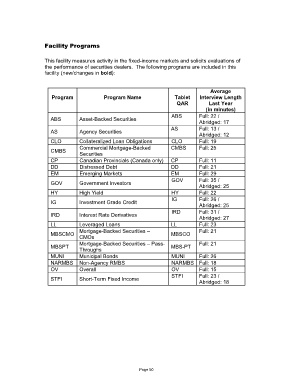

Facility Programs

This facility measures activity in the fixed-income markets and solicits evaluations of

the performance of securities dealers. The following programs are included in this

facility (new/changes in bold):

Average

Program Program Name Tablet Interview Length

QAR Last Year

(in minutes)

ABS Full: 22 /

ABS Asset-Backed Securities

Abridged: 17

AS Full: 13 /

AS Agency Securities

Abridged: 12

CLO Collateralized Loan Obligations CLO Full: 19

Commercial Mortgage-Backed CMBS Full: 25

CMBS

Securities

CP Canadian Provincials (Canada only) CP Full: 11

DD Distressed Debt DD Full: 21

EM Emerging Markets EM Full: 29

GOV Full: 35 /

GOV Government Investors

Abridged: 25

HY High Yield HY Full: 22

IG Full: 26 /

IG Investment Grade Credit

Abridged: 25

IRD Full: 31 /

IRD Interest Rate Derivatives

Abridged: 27

LL Leveraged Loans LL Full: 23

Mortgage-Backed Securities – Full: 21

MBSCMO MBSCO

CMOs

Mortgage-Backed Securities – Pass- Full: 21

MBSPT MBS-PT

Throughs

MUNI Municipal Bonds MUNI Full: 26

NARMBS Non-Agency RMBS NARMBS Full: 18

OV Overall OV Full: 15

STFI Full: 23 /

STFI Short-Term Fixed Income

Abridged: 18

Page 50