Page 72 - NAFIF-2019-Facility-Reference-Guide

P. 72

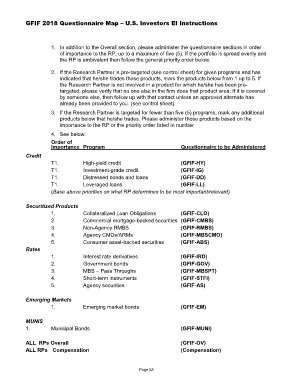

GFIF 2018 Questionnaire Map – U.S. Investors EI Instructions

1. In addition to the Overall section, please administer the questionnaire sections in order

of importance to the RP, up to a maximum of five (5). If the portfolio is spread evenly and

the RP is ambivalent then follow the general priority order below.

2. If the Research Partner is pre-targeted (see control sheet) for given programs and has

indicated that he/she trades those products, mark the products below from 1 up to 5. If

the Research Partner is not involved in a product for which he/she has been pre-

targeted, please verify that no one else in the firm does that product area. If it is covered

by someone else, then follow up with that contact unless an approved alternate has

already been provided to you. (see control sheet)

3. If the Research Partner is targeted for fewer than five (5) programs, mark any additional

products below that he/she trades. Please administer those products based on the

importance to the RP or the priority order listed in number

4. See below:

Order of

Importance Program Questionnaire to be Administered

Credit

T1. High-yield credit (GFIF-HY)

T1. Investment-grade credit (GFIF-IG)

T1. Distressed bonds and loans (GFIF-DD)

T1. Leveraged loans (GFIF-LL)

(Base above priorities on what RP determines to be most important/relevant)

Securitized Products

1. Collateralized Loan Obligations (GFIF-CLO)

2. Commercial mortgage-backed securities (GFIF-CMBS)

3. Non-Agency RMBS (GFIF-RMBS)

4. Agency CMOs/ARMs (GFIF-MBSCMO)

5. Consumer asset-backed securities (GFIF-ABS)

Rates

1. Interest rate derivatives (GFIF-IRD)

2. Government bonds (GFIF-GOV)

3. MBS – Pass Throughs (GFIF-MBSPT)

4. Short-term instruments (GFIF-STFI)

5. Agency securities (GFIF-AS)

Emerging Markets

1. Emerging market bonds (GFIF-EM)

MUNIS

1. Municipal Bonds (GFIF-MUNI)

ALL RPs Overall (GFIF-OV)

ALL RPs Compensation (Compensation)

Page 53