Page 6 - PennProject

P. 6

out the cement plugs in the well’s bore-hole. Once this has been completed, we will run

a new mud log and compare it to the original log. To complete the well, we will run pipe

into the bore-hole and set it with cement casing. Once dry, we can perforate the well

and complete it. We have a 6 minute video on the “Drilling and Operating” page of our

website that will show you this entire process. If you don’t know how wells are drilled,

we recommend you watch this video.

The cut off time for investors to send us their Purchase Agreements and payment to

participate on the Penn #1 project is April 7, 2018. In the event that the project is not

fully funded for the total of $200,000.00 by April 7, 2018, one of our company’s long

time investors has committed to purchase whatever working interest that remains

unsold. The drilling and completion time for this well is 2 weeks from the date the work

begins.

For you to participate, you need to fill out the Purchase Agreement, have it notarized,

and send it to us along with your payment. Please contact Clay Renshaw and he will

e-mail you the Purchase Agreement, banking information, and a checklist outlining what

you can expect from us as we move forward.

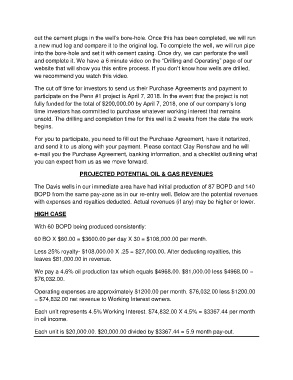

PROJECTED POTENTIAL OIL & GAS REVENUES

The Davis wells in our immediate area have had initial production of 87 BOPD and 140

BOPD from the same pay-zone as in our re-entry well. Below are the potential revenues

with expenses and royalties deducted. Actual revenues (if any) may be higher or lower.

HIGH CASE

With 60 BOPD being produced consistently:

60 BO X $60.00 = $3600.00 per day X 30 = $108,000.00 per month.

Less 25% royalty- $108,000.00 X .25 = $27,000.00. After deducting royalties, this

leaves $81,000.00 in revenue.

We pay a 4.6% oil production tax which equals $4968.00. $81,000.00 less $4968.00 =

$76,032.00.

Operating expenses are approximately $1200.00 per month. $76,032.00 less $1200.00

= $74,832.00 net revenue to Working Interest owners.

Each unit represents 4.5% Working Interest. $74,832.00 X 4.5% = $3367.44 per month

in oil income.

Each unit is $20,000.00. $20,000.00 divided by $3367.44 = 5.9 month pay-out.