Page 7 - PennProject

P. 7

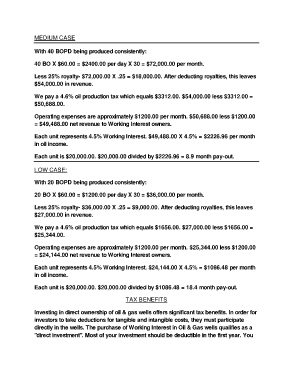

MEDIUM CASE

With 40 BOPD being produced consistently:

40 BO X $60.00 = $2400.00 per day X 30 = $72,000.00 per month.

Less 25% royalty- $72,000.00 X .25 = $18,000.00. After deducting royalties, this leaves

$54,000.00 in revenue.

We pay a 4.6% oil production tax which equals $3312.00. $54,000.00 less $3312.00 =

$50,688.00.

Operating expenses are approximately $1200.00 per month. $50,688.00 less $1200.00

= $49,488.00 net revenue to Working Interest owners.

Each unit represents 4.5% Working Interest. $49,488.00 X 4.5% = $2226.96 per month

in oil income.

Each unit is $20,000.00. $20,000.00 divided by $2226.96 = 8.9 month pay-out.

LOW CASE:

With 20 BOPD being produced consistently:

20 BO X $60.00 = $1200.00 per day X 30 = $36,000.00 per month.

Less 25% royalty- $36,000.00 X .25 = $9,000.00. After deducting royalties, this leaves

$27,000.00 in revenue.

We pay a 4.6% oil production tax which equals $1656.00. $27,000.00 less $1656.00 =

$25,344.00.

Operating expenses are approximately $1200.00 per month. $25,344.00 less $1200.00

= $24,144.00 net revenue to Working Interest owners.

Each unit represents 4.5% Working Interest. $24,144.00 X 4.5% = $1086.48 per month

in oil income.

Each unit is $20,000.00. $20,000.00 divided by $1086.48 = 18.4 month pay-out.

TAX BENEFITS

Investing in direct ownership of oil & gas wells offers significant tax benefits. In order for

investors to take deductions for tangible and intangible costs, they must participate

directly in the wells. The purchase of Working Interest in Oil & Gas wells qualifies as a

"direct investment". Most of your investment should be deductible in the first year. You