Page 12 - 2022 OCFJSD Benefits Guide

P. 12

Annual

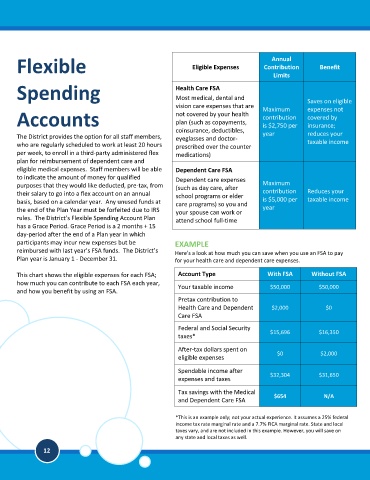

Flexible Eligible Expenses Contribution Benefit

Limits

Spending Health Care FSA

Most medical, dental and

vision care expenses that are Maximum Saves on eligible

expenses not

Accounts not covered by your health contribution covered by

plan (such as copayments,

coinsurance, deductibles, is $2,750 per insurance;

The District provides the option for all staff members, eyeglasses and doctor- year reduces your

who are regularly scheduled to work at least 20 hours prescribed over the counter taxable income

per week, to enroll in a third-party administered flex medications)

plan for reimbursement of dependent care and

eligible medical expenses. Staff members will be able Dependent Care FSA

to indicate the amount of money for qualified Dependent care expenses

purposes that they would like deducted, pre-tax, from (such as day care, after Maximum

their salary to go into a flex account on an annual school programs or elder contribution Reduces your

basis, based on a calendar year. Any unused funds at care programs) so you and is $5,000 per taxable income

the end of the Plan Year must be forfeited due to IRS your spouse can work or year

rules. The District’s Flexible Spending Account Plan attend school full-time

has a Grace Period. Grace Period is a 2 months + 15

day-period after the end of a Plan year in which

participants may incur new expenses but be EXAMPLE

reimbursed with last year’s FSA funds. The District’s Here’s a look at how much you can save when you use an FSA to pay

Plan year is January 1 - December 31. for your health care and dependent care expenses.

This chart shows the eligible expenses for each FSA; Account Type With FSA Without FSA

how much you can contribute to each FSA each year, Your taxable income $50,000 $50,000

and how you benefit by using an FSA.

Pretax contribution to

Health Care and Dependent $2,000 $0

Care FSA

Federal and Social Security

$15,696 $16,350

taxes*

After-tax dollars spent on

$0 $2,000

eligible expenses

Spendable income after

expenses and taxes $32,304 $31,650

Tax savings with the Medical

$654 N/A

and Dependent Care FSA

*This is an example only; not your actual experience. It assumes a 25% federal

income tax rate marginal rate and a 7.7% FICA marginal rate. State and local

taxes vary, and are not included in this example. However, you will save on

any state and local taxes as well.

12