Page 5 - FI Round Table Program MI Final

P. 5

2019 Plans

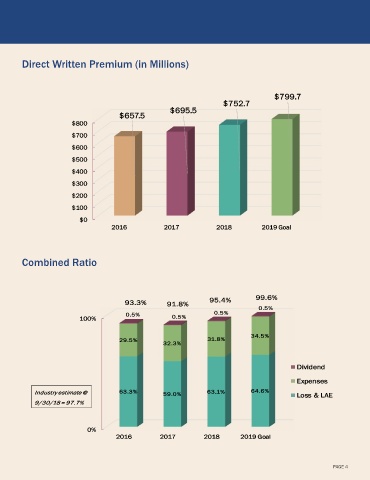

Direct Written Premium (in Millions)

Citizenship

• Expand scholarship programs through the Frankenmuth Insurance Scholarship Foundation Fund to include

children of agency employees who are pursuing a career in insurance

Growth

• Continue Commercial Lines’ positive growth momentum by achieving 5% growth

• Complete competitive analysis of Commercial Plus endorsement forms and enhance coverages to deliver a

market-competitive product

• Achieve profitable growth in Personal Lines by increasing written premium by 3.9%

• Research and recommend future actions to improve Personal Lines policy retention

• Research the use of telematics to expand product offerings

• Continue to expand Surety program by bringing it to Michigan and the Midwest

People

• Launch Commercial Lines Specialist Designation Program in Michigan, a three-day course for producers

designed to offer technical product knowledge, in-depth sales skills and certification

• Launch “Relationship Selling to Reach the Modern Buyer,” a one-day program focused on developing an agent

and/or producer’s skills to build relationships with their clients during the sales process

• Continue FI staff participation in the “Day in the Life of an Agent” program

• Implement “Navigating the Three P’s (People, Processes & Programs),” a training program for producers,

CSRs and CRAs to meet with key operational areas at the Home Office

• Expand delivery of The Indispensable CSR and Agency Staffing & Development training courses Combined Ratio

• Continue to offer CSR/Account Manager Life Cross Selling workshops to agencies

• Introduce Advanced Markets (key man, buy/sell, etc.) Life training program for agencies

Profit

• Continue strong retention in Commercial Lines while adjusting Commercial Auto and Workers’ Compensation

rates where necessary

• Focus on Commercial Auto profitability

• Improve Personal Auto results through increased pricing and further underwriting of unprofitable segments

• Enhance underwriting methodology for simplified issue life policies

Technology

• Complete rollout of remaining Commercial Lines states on the new platform for Policy and Billing

• Complete implementation of Claims Center for Legacy Personal Lines policies

• Continue working on the transformation of Personal Lines for Policy, Billing, Document Production and

Document Management

• Implement ACORD application Optical Character Recognition (OCR) service to streamline data entry for

Commercial applications

• Continue to collect agency feedback on new platform to drive ongoing enhancement priorities

• Begin planning Claims analytics initiatives

• Enhance pre- and post-issue push notifications for Life applications

• Implement enhanced Agency Blog platform for improved delivery of agency communications

PAGE 7 PAGE 4