Page 215 - AR DPBM-2016--SMALL

P. 215

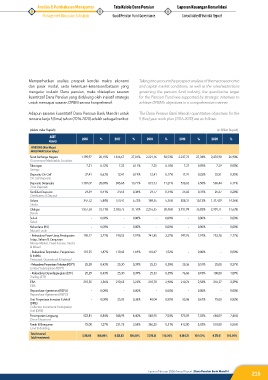

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

Memperhatikan analisis prospek kondisi makro ekonomi Taking into account the prospect analysis of the macroeconomic

dan pasar modal, serta ketentuan-ketentuan/batasan yang and capital market conditions, as well as the rules/restrictions

mengatur industri Dana pensiun, maka ditetapkan sasaran governing the pension fund industry, the quantitative target

kuantitatif Dana Pensiun yang didukung oleh inisiatif strategis for the Pension Fund was supported by strategic initiatives to

untuk mencapai sasaran DPBM secara konprehensif. achieve DPBM’s objectives in a comprehensive manner.

Adapun sasaran kuantitatif Dana Pensiun Bank Mandiri untuk The Dana Pensiun Bank Mandiri quantitative objectives for the

rencana kerja 5 (lima) tahun (2016-2020) adalah sebagai berikut: 5 (five) year work plan (2016-2020) are as follows:

(dalam miliar Rupiah) (in Billion Rupiah)

ASET 2016 % 2017 % 2018 % 2019 % 2020 %

Assets

INVESTASI (Nilai Wajar)

INVESTMENTS (Fair Value)

Surat berharga Negara 1.190,97 20,15% 1.816,67 27,81% 2.221,16 30,53% 2.237,72 27,34% 2,470,98 26,94%

Government Marketable Securities

Tabungan 7,21 0,12% 7,23 0,11% 7,25 0,10% 7,27 0,09% 7,29 0,08%

Savings

Deposito On Call 37,41 0,63% 12,41 0,19% 12,41 0,17% 17,91 0,22% 32,51 0,35%

On Call Deposits

Deposito Berjangka 1.187,07 20,08% 895,68 13,71% 815,73 11,21% 538,83 6,58% 560,44 6,11%

Time Deposits

Sertifikat Deposito 24,29 0,41% 24,53 0,38% 24,77 0,34% 25,02 0,31% 25,27 0,28%

Certificates of Deposit

Saham 347,72 5,88% 373,41 5,72% 389,35 5,35% 828,31 10,12% 1.317,09 14,36%

Stocks

Obligas 1.957,58 33,11% 2.033,75 31,14% 2,216,35 30,46% 2.931,99 35,82% 2.901,71 31,63%

Bonds

Sukuk - 0,00% - 0,00% - 0,00% - 0,00% - 0,00%

Sukuk

Reksadana (RD) - 0,00% - 0,00% - 0,00% - 0,00% - 0,00%

Mutual Funds

- Reksadana Pasar Uang,Pendapatan 190,12 3,22% 190,53 2,92% 241,85 3,32% 242,93 2,97% 253,78 2,77%

Tetap, Saham & Campuran

Money Market, Fixed Income, Stocks

& Mixed

- Reksadana Terproteksi, Penjaminan 110,35 1,87% 110,43 1,69% 110,67 1,52% - 0,00% - 0,00%

& Indeks

Protected, Guaranteed & Indexed

- Reksadana Penyertaan Terbatas (RDPT) 25,28 0,43% 25,30 0,39% 25,33 0,35% 25,36 0,31% 25,00 0,27%

Limited Subscription (RDPT)

- Reksadana Diperdagangkan (ETF) 25,29 0,43% 25,30 0,39% 25,33 0,35% 76,06 0,93% 100,00 1,09%

Trading (ETF)

EBA 210,55 3,56% 210,65 3,23% 210,70 2,90% 210,76 2,58% 210,37 2,29%

EBA

Repurchase Agreement (REPO) - 0,00% - 0,00% - 0,00% - 0,00% - 0,00%

Repurchase Agreement (REPO)

Unit Penyertaan Investasi Kolektif - 0,00% 25,03 0,38% 40,04 0,55% 55,06 0,67% 75,08 0,82%

(DIRE)

Collective Investment Participation

Unit (DIRE)

Penempatan Langsung 522,81 8,84% 548,95 8,40% 548,95 7,54% 575,09 7,03% 684,09 7,46%

Direct Placement

Tanah & Bangunan 75,00 1,27% 231,75 3,55% 386,25 5,31% 412,00 5,03% 510,00 5,56%

Land & Building

Total Investasi 5.911,64 100,00% 6.531,63 100,00% 7.276,14 100,00% 8.184,31 100,00% 9.173,61 100,00%

Total Investments

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

215