Page 212 - AR DPBM-2016--SMALL

P. 212

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

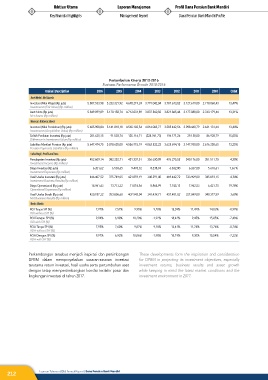

Pertumbuhan Kinerja 2010-2016

Business Performance Growth 2010-2016

Uraian | Description 2016 2015 2014 2013 2012 2011 2010 CAGR

Aset Neto | Net Assets

Investasi (Nilai Wajar) (Rp juta) 5.807.533,98 5.233.321,92 4.690.219,24 3.791.042,04 3.781.613,82 3.127.619,00 2.718.060,43 13,49%

Investments (Fair Value) (Rp million)

Aset Neto (Rp juta) 5.849.099,89 5.170.158,74 4.712.031,89 3.837.560,50 3.821.865,44 3.177.088,00 2.763.179,44 13,31%

Net Assets (Rp million)

Neraca | Balance Sheet

Investasi (Nilai Perolehan) (Rp juta) 5.605.908,84 5.141.818,18 4.565.102,54 4.016.003,77 3.585.442,56 3.098.460,79 2.631.131,64 13,44%

Investments (Acquisitiion Value) (Rp million)

Selisih Penilaian Investasi (Rp juta) 201.625,15 91.503,74 125.116,71 (224.961,73) 196.171,26 29.158,00 86.928,79 15,05%

Difference in Investment Value (Rp million)

Liabilitas Manfaat Pensiun (Rp juta) 5.647.474,75 5.078.655,00 4.586.915,19 4.062.522,23 3.625.694,18 3.147.930,00 2.676.250,65 13,25%

Pension Payments Liabilities (Rp million)

Laba Rugi | Profit and Loss

Pendapatan Investasi (Rp juta) 452.609,14 382.252,71 431.337,51 356.630,09 476.275,52 340.176,00 351.511,75 4,30%

Investment Income (Rp million)

Biaya Investasi (Rp juta) 6.201,62 6.503,65 9.478,32 8.238,69 6.832,80 6.267,00 5.618,61 1,66 %

Investment Expenses (Rp million)

Hasil Usaha Investasi (Rp juta) 446.407,52 375.749,05 421.859,19 348.391,40 469.442,72 333.909,00 345.893,15 4,34%

Investment Business Results (Rp million)

Biaya Operasional (Rp juta) 18.961,43 13.713,22 11.018,56 8.864,99 7.745,13 7.942,53 6.421,75 19,78%

Operational Expenses (Rp million)

Hasil Usaha Bersih (Rp juta) 420.957,32 353.806,60 407.943,04 341.439,71 457.481,02 327.049,00 340.377,59 3,60%

Net Business Results (Rp million)

Rasio | Ratio

ROI Tanpa SPI (%) 7,97% 7,57% 9,95% 9,20% 13,59% 11,42% 14,03% -8,99%

ROI without SPI (%)

ROI Dengan SPI (%) 9,94% 6,90% 18,20% -1,92% 18,42% 9,45% 15,85% -7,48%

ROI with SPI (%)

ROA Tanpa SPI (%) 7,95% 7,60% 9,87% 9,10% 13,41% 11,24% 13,76% -8,74%

ROA without SPI (%)

ROA Dengan SPI (%) 9,91% 6,92% 18,06% -1,90% 18,19% 9,30% 15,54% -7,22%

ROA with SPI (%)

Perkembangan tersebut menjadi inspirasi dan pertimbangan These developments form the inspiration and consideration

DPBM dalam memproyeksikan sasaran-sasaran investasi for DPBM in projecting its investment objectives, especially

terutama return investasi, hasil usaha serta pertumbuhan aset investment returns, business results and asset growth

dengan tetap mempertimbangkan kondisi terakhir pasar dan while keeping in mind the latest market conditions and the

lingkungan investasi di tahun 2017. investment environment in 2017.

212 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri