Page 207 - AR DPBM-2016--SMALL

P. 207

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

• Relatif suksesnya program Pemerintah terkait tax • The relative success of the Government program

amnesty memberikan pengaruh positif terhadapnya related to tax amnesty had a positive effect on rising

meningkatnya likuiditas rupiah dan berpotensi rupiah liquidity and potentially increasing the share

meningkatkan porsi investor lokal yang berinvestasi of local investors investing in Indonesian Government

pada SBN Indonesia sehingga dapat mengurangi Marketable Securities so as to reduce the dependence

ketergantungan dana dari investor asing of funds from foreign investors

• Himbauan OJK untuk menurunkan suku bunga perbankan • OJK’s appeal to lower bank interest rates and limit

dan membatasi NIM perbankan nasional menyebabkan national banking NIMs has caused banks to lower their

bank menurunkan bunga kreditnya dan bunga dana pihak loan interest and third party fund interest (a.l. deposit

ketiga (a.l. deposito dan deposit on call) sejak awal Q2 2016. and deposit on call) since the beginning of Q2 2016.

Atas dasar perkembangan dan realisasi kondisi makro On the basis of the development and realization of domestic

ekonomi domestik pada awal tahun Q4 2016, asumsi makro macroeconomic conditions at the beginning of Q4 2016,

ekonomi dari CFO Bank Mandiri dan dari beberapa Manajer macroeconomic assumptions from Bank Mandiri CFOs and

Investasi DPBM serta perkiraan makro ekonomi dalam APBN from several DPBM Investment Managers and macroeconomic

2017, maka ditetapkan beberapa asumsi RKAPB 2017 dengan estimates in APBN 2017, helped set several assumptions of

2 (dua) skenario sebagai berikut: RKAPB 2017 with 2 (two) scenarios as follows :

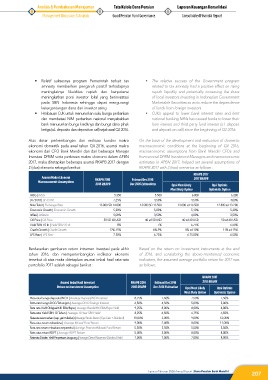

RKAPB 2017

Asumsi Makro Ekonomi 2017 RKAPB

RKAPB 2016

Estimasi Des 2016

Macroeconomic Assumptions 2016 RKAPB Dec 2016 Estimations

Opsi Most Likely Opsi Optimis

Most likely Option Optimistic Option

IHSG | IHSG 5.350 5.500 6.000 6.200

BI 7D RR | BI 7D RR 7,25% 4,50% 4,50% 4,00%

Nilai Tukar | Exchange Rate 13.000 SD 14.000 13.000 SD 13.500 13.000 sd 13.500 12.800 sd 13.200

Economic Growth | Economic Growth 5,20% 5,00% 5,10% 5,30%

Inflasi | Inflation 5,00% 3,50% 4,00% 3,50%

Oil Price | Oil Price 50 SD 60 USD 40 sd 50 USD 40 sd 60 USD 50 sd 60 USD

Yield SBN 10 th | Yield SBN 10 th 8% 7% 6,75% 6,50%

Credit Growth | Credit Growth 12%-15% 6%-9% 8% sd 10% 11% sd 15%

LPS Rate | LPS Rate 7.50% 6.75% 6.75.00% 6.50%

Berdasarkan gambaran return intrumen investasi pada akhir Based on the return on investment instruments at the end

tahun 2016, dan mempertimbangkan indikator ekonomi of 2016, and considering the above-mentioned economic

tersebut di atas maka ditetapkan asumsi imbal hasil rata-rata indicators, the assumed average portfolio return for 2017 was

portofolio 2017 adalah sebagai berikut : as follows:

RKAPB 2017

Asumsi Imbal Hasil Investasi RKAPB 2016 Estimasi Des 2016 2017 RKAPB

Return on Investment Assumption 2016 RKAPB Dec 2016 Estimation Opsi Most Likely Opsi Optimis

Most likely Option Optimistic Option

Rata-rata bunga deposito/NCD | Average Deposit/NCD Interest 8,75% 7,50% 7,50% 7,50%

Rata-rata bunga DOC/Tabungan | Average DOC/Savings Interest 6,50% 4,50% 5,00% 5,00%

Rata-rata Yield Obligasi/KIK EBA/Repo | Average Bonds/KIK EBA/Repo Yield 9,25% 8,00% 8,00% 8,00%

Rata-rata Yield SBN 10 Tahun | Average 10 Year SBN Yield 8,25% 6,50% 6,75% 6,50%

Rata-rata return saham (cap. gain+dividen) | Average Stocks Return (Cap Gain + Dividend) 10,00% 3,00% 9,00% 12,00%

Rata-rata return reksadana | Average Mutual Fund Return 9,00% 2,00% 8,00% 11,00%

Rata-rata return reksadana terproteksi | Average ProtectedMutuak Fund Return 5,50% 5,50% 5,50% 5,50%

Rata-rata return RDPT | Average RDPT Return 5,00% 5,00% 8,00% 8,00%

Rata-rata Dividen Yield Penyertaan Langsung | Average Direct Placement Dividend Yield 7,00% 7,00% 7,00% 8,00%

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

207