Page 211 - AR DPBM-2016--SMALL

P. 211

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

Atas dasar prakiraan kondisi tersebut di atas, dan kondisi terkini On the basis of the forecasts of the above conditions and the

pada akhir tahun 2016 serta memperhatikan asumsi yang current conditions at the end of 2016 and taking into account

digunakan oleh para analis, APBN Tahun 2017, serta Proyeksi the assumptions used by analysts, the 2017 APBN and the

kondisi makro ekonomi dari Bank Mandiri maka DPBM memilih projected macroeconomic conditions of Bank Mandiri, DPBM

skenario Optimis sebagai pijakan dalam penyusunan RKAPB chose the Optimistic scenario as a foothold in the preparation

2017, dengan target Aset Neto, Hasil Usaha Bersih dan ROI of the 2017 RKAPB, with Net Assets, Net Operating Results

sebagai berikut: and ROI as follows:

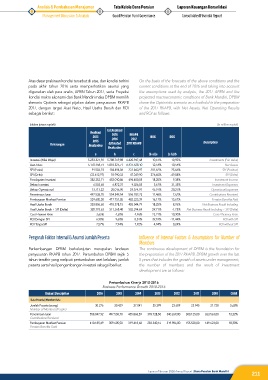

(dalam jutaan rupiah) (in million rupiah)

Est.Realisasi

Realisasi 2016 RKAPB

2015 ROG ROG

2015 2016 2017

Keterangan Realization Estimated 2017 RKAPB Description

Realization

a b c (b-a)/a (c-b)/b

Investasi (Nilai Wajar) 5.233.321,92 5.788.769,88 6.420.947,48 10,61% 10,92% Investments (Fair Value)

Aset Neto 5.170.158,74 5.818.325,71 6.431.528.10 12,54% 10,54% Net Assets

SPI (Posisi) 91.503,74 184.494,06 231.843,97 -101,62% 25,66% SPI (Position)

SPI (Delta) (33.612,97) 92.990,33 47.349,90 376,65% -49,08% SPI (Delta)

Pendapatan Investasi 382.252,71 452.010,86 494.400,05 18,25% 9,38% Investment Income

Beban Investasi 6.503,65 6.872,31 9.026,85 5,67% 31,35% Investment Expenses

Beban Operasional 13.713,22 20.016,90 24.074,91 45,97% 20,27% Operational Expenses

Penerimaan Iuran 497.538,70 554.549,54 596.782,23 11,46% 7,62% Contributions Received

Pembayaran Manfaat Pensiun 359.605,50 417.751,05 483.225,39 16,17% 15,67% Pension Benefits Paid

Hasil Usaha Bersih 353.806,60 418.378,15 455.044,79 18,25% 8,76% Net Business Result Including

Hasil Usaha Bersih + SPI (Delta) 320.193,63 511.368,48 502.394,69 59,71% -1,75% Net Business Result Including + SPI (Delta)

Cost Efisiensi Ratio 3,65% 4,50% 4,96% 23,21% 10,30% Cost Efficiency Ratio

ROI Dengan SPI 6,90% 9,60% 8,51% 39,18% -11,44% ROI with SPI

ROI Tanpa SPI 7,57% 7,94% 7,92% 4,94% -0,24% ROI without SPI

Pengaruh Faktor Internal & Asumsi Jumlah Peserta Influence of Internal Factors & Assumptions for Number of

Members

Perkembangan DPBM berkelanjutan merupakan landasan The continuous development of DPBM is the foundation for

penyusunan RKAPB tahun 2017. Pertumbuhan DPBM sejak 5 the preparation of the 2017 RKAPB. DPBM growth over the last

tahun terakhir yang meliputi pertumbuhan aset kelolaan, jumlah 5 years that includes the growth of assets under management,

peserta serta hasil pengembangan investasi sebagai berikut: the number of members and the result of investment

development are as follows:

Pertumbuhan Kinerja 2010-2016

Business Performance Growth 2010-2016

Uraian | Description 2016 2015 2014 2013 2012 2011 2010 CAGR

Data Peserta | Member Data

Jumlah Peserta (orang) 30.276 30.429 27.041 25.399 23.609 23.945 21.728 5,68%

Number of Members (People)

Penerimaan Iuran 558.047,92 497.538,70 435.868,59 378.728,50 340.269,00 300.125,00 263.563,00 13,32%

Contributions Received

Pembayaran Manfaat Pensiun 410.185,49 359.605,50 319.418,68 283.340,16 319.986,00 155.528,00 149.623,00 18,30%

Pension Benefits Oaid

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

211