Page 453 - AR DPBM-2016--SMALL

P. 453

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

DANA PENSIUN BANK MANDIRI DANA PENSIUN BANK MANDIRI

ANALISA INVESTASI DAN INVESTMENT ANALYSIS AND

CATATAN ATAS LAPORAN INVESTASI NOTES TO THE STATEMENT OF INVESTMENTS

(Lanjutan) (Continued)

Untuk Tahun yang Berakhir pada For the Year Ended

Tanggal 31 Desember 2016 December 31, 2016

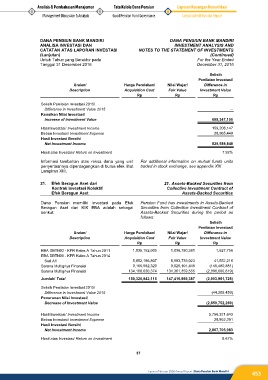

Selisih

Penilaian Investasi/

Uraian/ Harga Perolehan/ Nilai Wajar/ Difference in

Description Acquisition Cost Fair Value Investment Value

Rp Rp Rp

Selisih Penilaian Investasi 2015/

Difference in Investment Value 2015 --

Kenaikan Nilai Investasi/

Increase of Investment Value 699,347,150

Hasil Investasi/ Investment Income 159,208,147

Beban Investasi/ Investment Expense 28,965,449

Hasil Investasi Bersih/

Net Investment Income 829,589,848

Hasil atas Investasi/ Return on Investment 7.92%

Informasi tambahan atas reksa dana yang unit For additional information on mutual funds units

penyertaannya diperdagangkan di bursa efek lihat traded in stock exchange, see appendix XIII.

Lampiran XIII.

21. Efek Beragun Aset dari 21. Assets-Backed Securities from

Kontrak Investasi Kolektif Collective Investment Contract of

Efek Beragun Aset Assets-Backed Securities

Dana Pensiun memiliki investasi pada Efek Pension Fund has investments in Assets-Backed

Beragun Aset dari KIK EBA adalah sebagai Securities from Collective Investment Contract of

berikut: Assets-Backed Securities during the period as

follows:

Selisih

Penilaian Investasi/

Uraian/ Harga Perolehan/ Nilai Wajar/ Difference in

Description Acquisition Cost Fair Value Investment Value

Rp Rp Rp

EBA DBTN02 - KPR Kelas A Tahun 2011 1,035,152,605 1,036,780,361 1,627,756

EBA DBTN05 - KPR Kelas A Tahun 2014

Seri A1 5,952,186,807 5,993,739,023 41,552,216

Sarana Multigriya Finansial 9,165,582,329 9,025,101,448 (140,480,881)

Sarana Multigriya Finansial 134,168,020,374 131,361,359,555 (2,806,660,819)

Jumlah/ Total 150,320,942,115 147,416,980,387 (2,903,961,728)

Selisih Penilaian Investasi 2015/

Difference in Investment Value 2015 (44,209,459)

Penurunan Nilai Investasi/

Decrease of Investment Value (2,859,752,269)

Hasil Investasi/ Investment Income 5,756,321,643

Beban Investasi/ Investment Expense 28,863,391

Hasil Investasi Bersih/

Net Investment Income 2,867,705,983

Hasil atas Investasi/ Return on Investment 8.67%

Final draft/March 2, 2017 paraf:

37

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

453