Page 17 - AAG Benefits Guide OOS (Non-CA) Employees

P. 17

2021 16

401(K) SAVINGS PLAN

Building a healthy financial future is just

as important as taking care of your

health needs today. Putting money

aside for your future is easy

with the 401(k) Plan. Employees are

eligible to enroll in the 401k after 60

days of continuous employment with

quarterly entry into the plan.

Plan Features Vesting

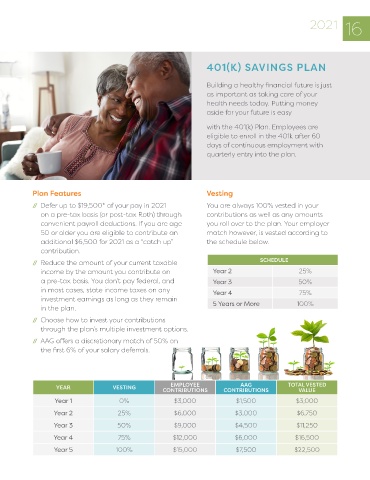

// Defer up to $19,500* of your pay in 2021 You are always 100% vested in your

on a pre-tax basis (or post-tax Roth) through contributions as well as any amounts

convenient payroll deductions. If you are age you roll over to the plan. Your employer

50 or older you are eligible to contribute an match however, is vested according to

additional $6,500 for 2021 as a “catch up” the schedule below.

contribution.

// Reduce the amount of your current taxable SCHEDULE

income by the amount you contribute on Year 2 25%

a pre-tax basis. You don’t pay federal, and Year 3 50%

in most cases, state income taxes on any Year 4 75%

investment earnings as long as they remain

in the plan. 5 Years or More 100%

// Choose how to invest your contributions

through the plan’s multiple investment options.

// AAG offers a discretionary match of 50% on

the first 6% of your salary deferrals.

YEAR VESTING EMPLOYEE AAG TOTAL VESTED

CONTRIBUTIONS CONTRIBUTIONS VALUE

Year 1 0% $3,000 $1,500 $3,000

Year 2 25% $6,000 $3,000 $6,750

Year 3 50% $9,000 $4,500 $11,250

Year 4 75% $12,000 $6,000 $16,500

Year 5 100% $15,000 $7,500 $22,500