Page 232 - International Marketing

P. 232

NPP

234 International Marketing BRILLIANT'S

addition to the Opening Bank, provided the

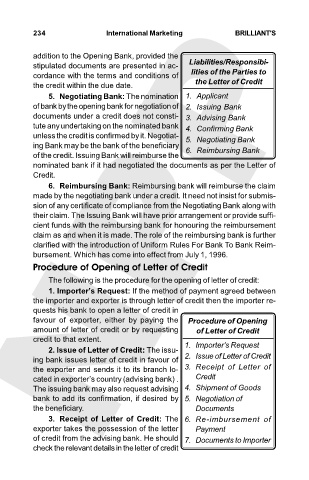

stipulated documents are presented in ac- Liabilities/Responsibi-

cordance with the terms and conditions of lities of the Parties to

the credit within the due date. the Letter of Credit

5. Negotiating Bank: The nomination 1. Applicant

of bank by the opening bank for negotiation of 2. Issuing Bank

documents under a credit does not consti- 3. Advising Bank

tute any undertaking on the nominated bank 4. Confirming Bank

unless the credit is confirmed by it. Negotiat- 5. Negotiating Bank

ing Bank may be the bank of the beneficiary 6. Reimbursing Bank

of the credit. Issuing Bank will reimburse the

nominated bank if it had negotiated the documents as per the Letter of

Credit.

6. Reimbursing Bank: Reimbursing bank will reimburse the claim

made by the negotiating bank under a credit. It need not insist for submis-

sion of any certificate of compliance from the Negotiating Bank along with

their claim. The Issuing Bank will have prior arrangement or provide suffi-

cient funds with the reimbursing bank for honouring the reimbursement

claim as and when it is made. The role of the reimbursing bank is further

clarified with the introduction of Uniform Rules For Bank To Bank Reim-

bursement. Which has come into effect from July 1, 1996.

Procedure of Opening of Letter of Credit

The following is the procedure for the opening of letter of credit:

1. Importer’s Request: If the method of payment agreed between

the importer and exporter is through letter of credit then the importer re-

quests his bank to open a letter of credit in

favour of exporter, either by paying the Procedure of Opening

amount of letter of credit or by requesting of Letter of Credit

credit to that extent.

2. Issue of Letter of Credit: The issu- 1. Importer’s Request

ing bank issues letter of credit in favour of 2. Issue of Letter of Credit

the exporter and sends it to its branch lo- 3. Receipt of Letter of

cated in exporter’s country (advising bank) . Credit

The issuing bank may also request advising 4. Shipment of Goods

bank to add its confirmation, if desired by 5. Negotiation of

the beneficiary. Documents

3. Receipt of Letter of Credit: The 6. Re-imbursement of

exporter takes the possession of the letter Payment

of credit from the advising bank. He should 7. Documents to Importer

check the relevant details in the letter of credit