Page 234 - International Marketing

P. 234

NPP

236 International Marketing BRILLIANT'S

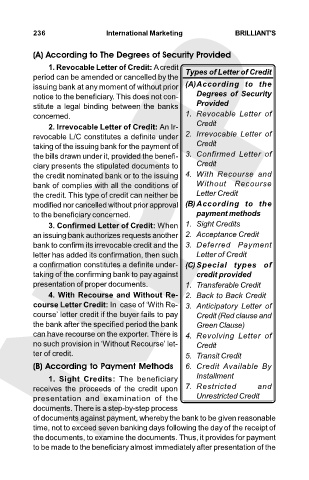

(A) According to The Degrees of Security Provided

1. Revocable Letter of Credit: A credit

period can be amended or cancelled by the Types of Letter of Credit

issuing bank at any moment of without prior (A)According to the

notice to the beneficiary. This does not con- Degrees of Security

stitute a legal binding between the banks Provided

concerned. 1. Revocable Letter of

2. Irrevocable Letter of Credit: An Ir- Credit

revocable L/C constitutes a definite under 2. Irrevocable Letter of

taking of the issuing bank for the payment of Credit

the bills drawn under it, provided the benefi- 3. Confirmed Letter of

ciary presents the stipulated documents to Credit

the credit nominated bank or to the issuing 4. With Recourse and

bank of complies with all the conditions of Without Recourse

the credit. This type of credit can neither be Letter Credit

modified nor cancelled without prior approval (B)According to the

to the beneficiary concerned. payment methods

3. Confirmed Letter of Credit: When 1. Sight Credits

an issuing bank authorizes requests another 2. Acceptance Credit

bank to confirm its irrevocable credit and the 3. Deferred Payment

letter has added its confirmation, then such Letter of Credit

a confirmation constitutes a definite under- (C)Special types of

taking of the confirming bank to pay against credit provided

presentation of proper documents. 1. Transferable Credit

4. With Recourse and Without Re- 2. Back to Back Credit

course Letter Credit: In case of ‘With Re- 3. Anticipatory Letter of

course’ letter credit if the buyer fails to pay Credit (Red clause and

the bank after the specified period the bank Green Clause)

can have recourse on the exporter. There is 4. Revolving Letter of

no such provision in ‘Without Recourse’ let- Credit

ter of credit. 5. Transit Credit

(B) According to Payment Methods 6. Credit Available By

1. Sight Credits: The beneficiary Installment

receives the proceeds of the credit upon 7. Restricted and

presentation and examination of the Unrestricted Credit

documents. There is a step-by-step process

of documents against payment, whereby the bank to be given reasonable

time, not to exceed seven banking days following the day of the receipt of

the documents, to examine the documents. Thus, it provides for payment

to be made to the beneficiary almost immediately after presentation of the