Page 233 - International Marketing

P. 233

NPP

BRILLIANT'S Export Management 235

and in case there is any discrepancy, the same should be brought to the

notice of advising bank.

4. Shipment of Goods: The exporter fulfills the shipping and cus-

toms procedure and collects the required documents from various authori-

ties for negotiation.

5. Negotiation of Documents: The exporters submit the required

documents to the negotiating bank, which scrutinizes the documents and

makes payment to the exporter.

6. Re-imbursement of Payment: The negotiating bank gets the

payment reimbursed from the issuing bank.

7. Documents to Importer: The documents forwarded to the issuing

bank by the negotiating bank are handed over to the importer and the

amount is debited to his account.

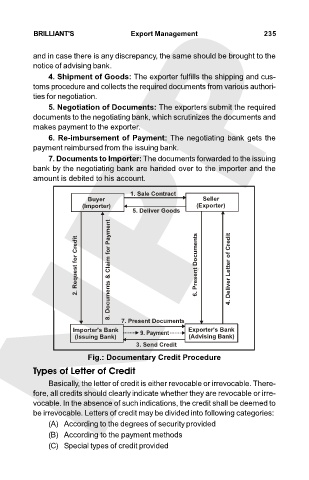

1. Sale Contract

Buyer Seller

(Importer) (Exporter)

5. Deliver Goods

2. Request for Credit 8. Documents & Claim for Payment 6. Present Documents 4. Deliver Letter of Credit

Importer's Bank 7. Present Documents Exporter's Bank

(Issuing Bank) (Advising Bank)

3. Send Credit

Fig.: Documentary Credit Procedure

Types of Letter of Credit

Basically, the letter of credit is either revocable or irrevocable. There-

fore, all credits should clearly indicate whether they are revocable or irre-

vocable. In the absence of such indications, the credit shall be deemed to

be irrevocable. Letters of credit may be divided into following categories:

(A) According to the degrees of security provided

(B) According to the payment methods

(C) Special types of credit provided