Page 34 - FY18 Advanced Services Strategic Plan

P. 34

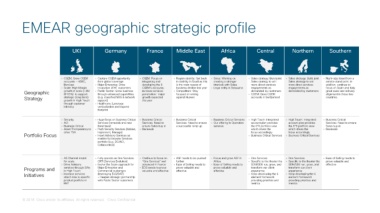

EMEAR geographic strategic profile

UKI Germany France Middle East Africa Central Northern Southern

• CGEM; Grow CGEM • Capture CGEM opportunity • CGEM: Focus on • Region stability: Get back • Sales: Working on • Sales strategy: Build joint • Sales strategy: Build joint • Right-size Israel from a

accounts – HSBC, from global coverage integrating and to stability in Saudi as this creating a stronger Sales strategy to win Sales strategy to win service stand point. In

Barclays • Major Enterprise: Drive developing the 9 is the main reason of interlock with Sales more direct services more direct services addition, continue to

• Scale: High Margin Incubation of HT customers CGEM’s accounts; business decline last year • Legal entity in Botswana engagements as engagements as focus on Spain and Italy;

demanded by customers

Geographic growth in scale (+4M • Public Sector: Grow business increase services • Competitors: Stay • CGEM: Grow CGEM demanded by customers great sales and delivery

@ 65%) to support

focused on wining

through enhanced capabilities

alignment in those two

penetration- major

Strategy strategic (long term) (e.g. classified NOS & network growth expected against Huawei accounts in Switzerland countries.

this year

support)

growth in High Touch

through customer • Healthcare: Leverage

intimacy verticalization and expand

footprint

• Security • Huge focus on Business Critical • Business Critical • Business Critical • Business Critical Services • High Touch: Integrated • High Touch: Integrated • Business Critical

• ACI Services (renewals and new Services. Need to Services. Need to ensure • Our offering in Operation account plan provides account plan provides Services. Need to ensure

• Business Critical franchises) ensure Sales buy in a successful ramp up services the 6*6 portfolio view the 6*6 portfolio view Sales buy in

• Asset Transparency to • Push Security Services (Advise, • Renewals which drives the which drives the • Renewals

drive TSA Implement, Manage) focus accordingly focus accordingly

Portfolio Focus • Insert Advisory Services as • Business Critical Services • Business Critical Services

enabler for broader Services

portfolio (e.g. DC/ACI,

Collaboration)

• AS Channel model • Fully operate as One Services • Continue to focus on • ASF needs to be pushed • Focus and grow ASF in • One Services • One Services • Ease of Selling needs to

for scale CRT (Services Evolution) “One Services” well further Africa • Specific to the theater the • Specific to the theater the prove valuable and

• Drive Advisory • Evolve the Scale approach for advanced in France • Ease of Selling needs to • Ease of Selling needs to SDM/SDE run, grow, and SDM/SDE run, grow, and effective

Programs and services through SIAs Major Enterprise and • EOS needs to prove prove valuable and prove valuable and transform our client transform our client

valuable and effective

experience

effective

effective

experience

Commercial customers

in High Touch

Initiatives • Increase services (leveraging EoS/DAT) • Keep developing the 6 • Keep developing the 6

element framework

element framework

- Deepen strategic partnership

attach rate to specific

product portfolio in with Public Sector customers providing priorities and providing priorities and

ENT metrics metrics

© 2018 Cisco and/or its affiliates. All rights reserved. Cisco Confidential