Page 37 - FY18 Advanced Services Strategic Plan

P. 37

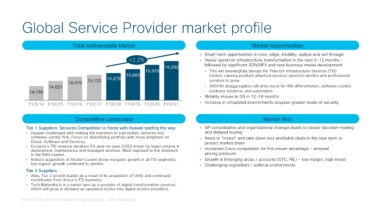

Global Service Provider market profile

Total Addressable Market Market Opportunities

• Short-term opportunities in core, edge, mobility, optical and sell through

+2.2% • Heavy spend on infrastructure transformation in the next 6–12 months -

16,292 followed by significant SDN/NFV and new business model development

15,970 • This will meaningfully disrupt the Telecom Infrastructure Services (TIS)

15,603 market, causing product-attached services spend to decline and professional

15,275

14,975 15,133 services to grow

14,621 • SW/HW disaggregation will drive need for HW differentiation, software-centric

14,185 business solutions, and automation

• Mobility moves to 5G in 12-18 months

FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 • Increase in virtualized environments requires greater levels of security

Competitive Landscape Market Risk

Tier 1 Suppliers: Services Competition is fierce with Huawei leading the way • SP consolidation and organizational changes leads to slower decision-making

• Huawei challenged with making the transition to a proactive, services-led, and delayed buying

software-centric firm. Focus on diversifying portfolio with more emphasis on • Need to “invest” and take down less profitable deals in the near term to

Cloud, Software and Services. protect market share

• Ericsson’s TIS revenue declined 5% year-to-year (USD) driven by lower volume in • Increased Cisco competition for first mover advantage – renewal

deployment, maintenance and managed services. Most exposed to the downturn

in the RAN market. pricing pressure

• Nokia’s acquisition of Alcatel-Lucent drove inorganic growth in all TIS segments, • Growth in Emerging areas / accounts (STC, RIL) – low margin, high invest

but organic growth continued to decline. • Challenging regulations / political environments

Tier 2 Suppliers

• Atos, Tier 2 growth leader as a result of its acquisition of Unify and continued

contribution from Xerox’s ITO business.

• Tech Mahindra is in a sweet spot as a provider of digital transformation services,

which will grow in demand as operators evolve into digital service providers.

© 2018 Cisco and/or its affiliates. All rights reserved. Cisco Confidential