Page 12 - 2018 Turnberry Associates Guide Boston

P. 12

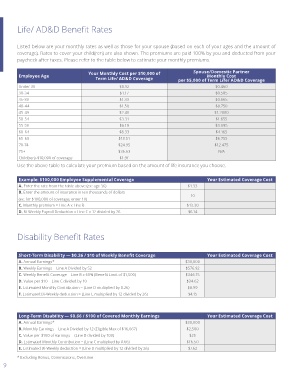

Life/ AD&D Benefit Rates

Listed below are your monthly rates as well as those for your spouse (based on each of your ages and the amount of

coverage). Rates to cover your child(ren) are also shown. The premiums are paid 100% by you and deducted from your

paycheck after taxes. Please refer to the table below to estimate your monthly premiums.

Your Monthly Cost per $10,000 of Spouse/Domestic Partner

Employee Age Term Life/ AD&D Coverage per $5,000 of Term Life/ AD&D Coverage

Monthly Cost

Under 30 $0.92 $0.460

30-34 $1.17 $0.585

35-39 $1.33 $0.665

40-44 $1.50 $0.750

45-49 $2.40 $1.2000

50-54 $3.31 $1.655

55-59 $6.19 $3.095

60-64 $8.33 $4.165

65-69 $13.51 $6.755

70-74 $24.95 $12.475

75+ $36.63 N/A

Child(ren)-$10,000 of coverage $1.91

Use the above table to calculate your premium based on the amount of life insurance you choose.

Example: $100,000 Employee Supplemental Coverage Your Estimated Coverage Cost

A. Enter the rate from the table above (ex: age 36) $1.33

B. Enter the amount of insurance in ten thousands of dollars

10

(ex: for $100,000 of coverage, enter 10)

C. Monthly premium = Line A x Line B $13.30

D. Bi-Weekly Payroll Deduction = Line C x 12 divided by 26 $6.14

Disability Benefit Rates

Short-Term Disability — $0.26 / $10 of Weekly Benefit Coverage Your Estimated Coverage Cost

A. Annual Earnings* $30,000

B. Weekly Earnings = Line A Divided by 52 $576.92

C. Weekly Benefit Coverage = Line B x 60% (Benefit Limit of $1,500) $346.15

D. Value per $10 = Line C divided by 10 $34.62

E. Estimated Monthly Contribution = (Line D multiplied by 0.26) $8.99

F. Estimated Bi-Weekly deduction = (Line E multiplied by 12 divided by 26) $4.15

Long-Term Disability — $0.66 / $100 of Covered Monthly Earnings Your Estimated Coverage Cost

A. Annual Earnings* $30,000

B. Monthly Earnings = Line A Divided by 12 (Eligible Max of $16,667) $2,500

C. Value per $100 of earnings = (Line B divided by 100) $25

D. Estimated Monthly Contribution = (Line C multiplied by 0.66) $16.50

E. Estimated Bi-Weekly deduction = (Line D multiplied by 12 divided by 26) $7.62

* Excluding Bonus, Commissions, Overtime

9