Page 13 - Sample jcl

P. 13

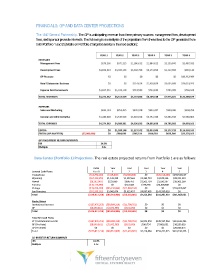

FINANCIALS: GP AND DATA CENTER PROJECTIONS

The 1547 General Partnership. The GP is anticipating revenue from three primary sources: management fees, development

fees, and sponsor promote interests. The following is an analysis of the projections from these fees to the GP generated from

both Portfolio 1 and 2 (details on Portfolio 2 targeted assets in the next section):

Data Center (Portfolio 1) Projections. The real estate projected returns from Portfolio 1 are as follows:

Initial Year Year Year Year Year

Levered Cash Flows: Year 0 1 2 3 4 5

Orangeburg ($54,792,630) ($118,363) ($8,500,004) $0 ($28,314,466) $159,543,627

Wyoming ($24,131,870) $1,311,120 $1,387,661 $1,465,719 $1,545,326 $38,991,319

Hawaii ($8,282,063) $223,860 $986,761 $1,502,724 $1,530,397 $18,903,268

Toronto ($18,115,869) $0 $127,428 $178,756 $34,908,840 $0

Chicago ($19,209,550) ($45,310,996) ($12,038,104) $0 $0 $134,424,467

San Francisco ($52,285,232) $3,042,474 $5,615,457 $4,067,485 $143,590,918 $0

Total ($176,817,214) ($40,851,905) ($12,420,801) $7,214,684 $153,261,015 $351,862,681

Equity Draws

Institutional Investor ($167,976,353) ($38,809,310) ($11,799,761) $0 $0 $0

GP ($8,840,861) ($2,042,595) ($621,040) $0 $0 $0

Total ($176,817,214) ($40,851,905) ($12,420,801) $0 $0 $0

Total Net Cash Flows

LP / Institutional Investor ($167,976,353) ($38,809,310) ($11,799,761) $6,853,950 $145,597,964 $314,636,396

GP (Pro Rata) ($8,840,861) ($2,042,595) ($621,040) $360,734 $7,663,051 $16,559,810

GP (Promote) $0 $0 $0 $0 $0 $20,666,475

Total ($176,817,214) ($40,851,905) ($12,420,801) $7,214,684 $153,261,015 $331,196,206

CO-INVESTOR RETURN SUMMARY

IRR 18.9%

Multiple 2.1x