Page 286 - ACCESS BANK ANNUAL REPORTS_eBook

P. 286

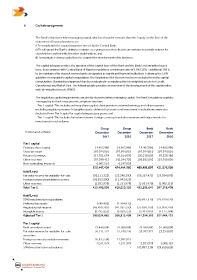

6 Capital management

The Bank’s objectives when managing capital, which is a broader concept than the ‘equity’ on the face of the

statement of financial position, are:

i) To comply with the capital requirements set by the Central Bank;

ii) To safeguard the Bank’s ability to continue as a going concern so that it can continue to provide returns for

shareholders and benefits for other stakeholders; and

iii) To maintain a strong capital base to support the development of its business.

The capital adequacy ratio is the quotient of the capital base of the Bank and the Bank’s risk weighted asset

base. In accordance with Central Bank of Nigeria regulations, a minimum ratio of 16% (15% + additional 1%) is

to be maintained for deposit money banks designated as significant financial institutions. Following the CBN

guideline on regulatory capital computation, the Regulatory Risk Reserve has been excluded from the capital

computation. Standardised approach has been adopted in computing the risk weighted assets for Credit,

Operetional, and Market Risk. The following table provides an overview of the development of the capital ratios

and risk-weighted assets (RWA):

The regulatory capital requirements are strictly observed when managing capital. The Bank’s regulatory capital is

managed by its Bank Treasury and comprises two tiers:

- Tier 1 capital: This includes ordinary share capital, share premium, retained earnings and other reserves

excluding regulatory reseres. Intangible assets, deferred tax assets and investment in subsidiaries were also

deducted from Tier I capital for capital adequacy purposes; and

- Tier 2 capital: This includes fair value reserves, foreign currency translation reserves with adjustments for

investments in subsidiaries.

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Tier 1 capital

Ordinary share capital 14,463,986 14,463,986 14,463,986 14,463,986

Share premium 197,974,816 197,974,816 197,974,816 197,974,816

Retained earnings 117,701,679 93,614,030 120,218,603 93,329,188

Other reserves 178,399,413 142,194,720 136,833,692 115,910,630

Non-controlling interests 6,907,515 6,247,028 - -

515,447,409 454,494,580 469,491,097 421,678,620

Add/(Less):

Fair value reserve for available-for-sale (36,111,322) (23,240,250) (35,267,471) (23,354,093)

Foreign currency translation reserves (26,813,500) (11,992,025) - -

Other reserves (2,031,978) (1,211,978) (2,031,978) (1,008,118)

Total Tier 1 450,490,608 418,050,326 432,191,647 397,316,409

Add/(Less):

50% Investments in subsidiaries - - (43,897,316) (29,619,626)

Deferred tax assets (740,402) (1,264,813) - -

Regulatory risk reserve (43,420,287) (42,932,550) (35,058,266) (35,058,266)

Intangible assets (8,295,855) (6,939,555) (5,981,905) (5,173,784)

Adjusted Tier 1 398,034,065 366,913,409 347,254,161 327,464,733

Tier 2 capital

Debt securities issued 79,440,000 97,600,000 79,440,000 97,600,000

Fair value reserve for available-for-sale 36,111,322 23,240,250 35,267,471 23,354,093

securities

Foreign currency translation reserves 26,813,500 11,992,025 - -

Other reserves 2,031,978 1,211,978 2,031,978 1,008,118

50% Investments in subsidiaries - - (43,897,316) (29,619,626)

286 Access BAnk Plc

Annual Report & Accounts 2017