Page 301 - ACCESS BANK ANNUAL REPORTS_eBook

P. 301

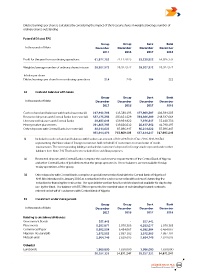

Diluted earnings per share is calculated by considering the impact of the treasury shares in weighted average number of

ordinary shares outstanding

Potential Diluted EPS

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Profit for the year from continuing operations 61,977,762 71,117,025 53,238,822 64,026,135

Weighted average number of ordinary shares in issue 28,927,972 28,927,972 28,927,972 28,927,972

In kobo per share

Diluted earnings per share from continuing operations 214 246 184 221

18 Cash and balances with banks

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Cash on hand and balances with banks (see note (i)) 217,912,766 115,380,195 177,809,307 106,594,205

Restricted deposits with Central Banks (see note (ii)) 357,173,356 250,831,529 354,986,209 248,547,664

Unrestricted balances with Central Banks 28,837,649 139,954,922 7,976,547 33,160,736

Money market placements 261,805,783 119,826,012 28,157,562 41,798,197

Other deposits with Central Banks (see note (iii)) 88,214,622 87,896,447 88,214,622 87,896,447

953,944,176 713,889,105 657,144,247 517,997,249

(i) Included in cash on hand and balances with banks is an amount of N33.045Bn (31 Dec 2016: N46.956Bn)

representing the Naira value of foreign currencies held on behalf of customers to cover letter of credit

transactions. The corresponding liability is included in customer’s deposit for foreign trade reported under other

liabilities (see Note 34). This has been excluded for cash flow purposes.

(ii) Restricted deposits with Central Banks comprise the cash reserve requirements of the Central Bank of Nigeria

and other Central Banks of jurisdictions that the group operates in. These balances are not available for day

to day operations of the group.

(iii) Other deposits with Central Banks comprise a special intervention fund with the Central Bank of Nigeria of

N49.6Bn introduced in January 2016 as a reduction in the cash reserve ratio with a view of channeling the

reduction to financing the real sector. The special intervention fund is restricted and not available for day to day

use by the Bank. The balance of N35.39Bn represents the nominal value of outstanding forward contracts

entered on behalf of customers with Central Bank of Nigeria.

19 Investment under management

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Relating to unclaimed dividends:

Government Bonds 357,441 - 357,441 -

Placements 6,283,077 1,070,385 6,283,077 1,070,385

Commercial Paper 6,992,904 6,454,067 6,992,904 6,454,067

Nigerian Treasury Bills 1,972,963 2,887,102 1,972,963 2,887,102

Mutual Funds 2,664,746 2,629,693 2,664,746 2,629,693

Other(s)

Eurobonds 1,986,000 1,830,000 1,986,000 1,830,000

20,257,131 14,871,247 20,257,131 14,871,247

Access BAnk Plc 301

Annual Report & Accounts 2017