Page 296 - ACCESS BANK ANNUAL REPORTS_eBook

P. 296

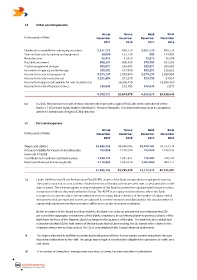

13 Other operating income

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Dividends on available for sale equity securities 2,357,175 860,339 2,357,175 860,339

Gain on disposal of property and equipment 10,090 167,340 902 143,985

Rental income 23,973 43,839 23,973 36,509

Bad debt recovered 606,397 808,458 575,787 631,191

Cash management charges 269,671 265,683 269,671 265,683

Income from agency and brokerage 105,231 147,850 105,231 136,651

Income from asset management 3,274,157 1,030,994 3,274,157 1,030,994

Income from other investments 1,221,834 271,270 159,736 24,914

Income from disposal of available for sale securities (a) - 16,206,410 - 16,206,410

Income from other financial services 149,643 142,795 149,643 2,873

8,018,171 19,944,978 6,916,275 19,339,549

(a) In 2016, the income from sale of other investments represents a gain of N16.2bn on the divestment of the

Bank’s 17.65 percent equity stake in StanbicIBTC Pension Managers. This divestment was done in compliance

with the Central Bank of Nigeria (CBN) directive.

14 Personnel expenses

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Wages and salaries 51,643,332 48,450,043 39,220,187 39,323,574

Increase in liability for long term incentive plan 753,058 1,196,994 753,058 1,196,995

(see note 37 (a) (i))

Contributions to defined contribution plans 1,239,712 1,087,431 776,407 748,241

Restricted share performance plan (b) 1,170,693 1,061,070 1,023,860 884,777

54,806,795 51,795,538 41,773,512 42,153,587

(a) Under the Restricted Share Performance Plan (RSPP), shares of the Bank are awarded to employees based on

their performance at no cost to them. Under the terms of the plan, the shares vest over a 3 year period from the

date of award. The scheme applies to only employees of the Bank that meet the stipulated performance criteria

irrespective of where they work within the Group. The RSPP is an equity-settled scheme, where the Bank

recognizes an expense and a corresponding increase in equity. Initial estimates of the number of equity settled

instruments that are expected to vest are adjusted to current estimates and ultimately to the actual number of

equity settled instruments that vest unless differences are due to market conditions.

By the resolution of the Board and Shareholders, the Bank sets aside an amount not exceeding twenty (20)

per cent of the aggregate emoluments of the Bank’s employees in each financial year to purchase shares of the

Bank from the floor of the Nigerian Stock Exchange for the purpose of the plan. The Bank has also established

a Structured Entity (SE) to hold shares of the Bank purchased. Upon vesting, the SE transfers the shares to the

employee whose interest has vested. The SE is consolidated in the Group’s financial statements.

(i) The shares allocated to staff has a contractual vesting year of three to seven years commencing from the year

of purchase/allocation to the staff. The group has no legal or constructive obligation to repurchase or settle on a

cash basis.

(ii) The number and weighted-average exercise prices of shares has been detailed in table below;

296 Access BAnk Plc

Annual Report & Accounts 2017