Page 294 - ACCESS BANK ANNUAL REPORTS_eBook

P. 294

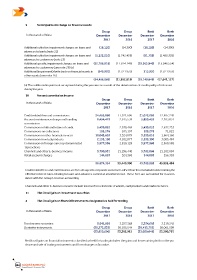

9 Net impairment charge on financial assets

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Additional collective impairment charges on loans and (18,120) (14,300) (18,120) (14,300)

advances to banks(note 22)

Additional collective impairment charges on loans and (1,132,010) (2,742,435) (81,719) (2,458,338)

advances to customers (note 23)

Additional specific impairment charges on loans and (32,766,818) (17,874,149) (29,365,940) (13,846,554)

advances to customers (see note 23) (a)

Additional (impairment)/write back on financial assets in (549,920) (1,321,935) 315,930 (1,321,935)

other assets (see note 26)

(34,466,868) (21,952,819) (29,149,849) (17,641,127)

(a) The additional impairment recognised during the year was as a result of the deterioration of credit quality of risk asset

during the year.

10 Fee and commission income

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Credit related fees and commissions 24,453,050 17,921,606 21,072,063 12,487,249

Account maintenance charge and handling 6,454,479 2,615,538 5,859,439 2,203,851

commission

Commission on bills and letters of credit 3,499,032 2,930,468 3,499,032 2,632,733

Commissions on collections 155,278 105,197 155,278 71,022

Commission on other financial services 10,043,893 3,324,878 3,139,616 1,664,160

Commission on virtual products 2,155,190 4,102,877 2,155,190 3,005,484

Commission on foreign currency denominated 3,977,588 2,819,128 3,977,588 2,569,588

transactions

Channels and other E-business income 5,790,931 21,296,440 5,782,886 21,102,094

Retail account charges 144,893 324,368 144,893 256,303

56,674,334 55,440,500 45,785,985 45,992,484

Credit related fees and commissions are fees charged to corporate customers other than fees included in determining the

effective interest rates relating to loans and advances carried at amortized cost. These fees are accounted for in accor-

dance with the Group’s revenue accounting.

Channels and other E-business income include income from electronic channels, card products and related services.

11 Net (loss)/gain on investment securities

a Net (loss)/gain on financial instruments designated as held for trading

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Fixed income securities 5,642,926 3,257,368 5,354,665 3,219,242

Derivative instruments (39,272,532) 50,105,544 (38,413,712) 50,061,509

(33,629,606) 53,362,912 (33,059,046) 53,280,751

Net (loss)/gains on financial instruments classified as held for trading includes the gains and losses arising both on the pur-

chase and sale of trading instruments and from changes in fair value.

294 Access BAnk Plc

Annual Report & Accounts 2017