Page 295 - ACCESS BANK ANNUAL REPORTS_eBook

P. 295

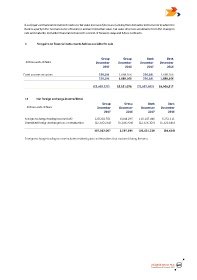

(Loss)/gain on financial instrument relates to fair value increase/(decrease) arising from derivative instruments to which the

Bank is a party in the normal course of business and are held at fair value. Fair value decrease would arise from the change in

rate and maturity. Derivative financial instruments consist of forward, swap and future contracts.

b Net gains on financial instruments held as available for sale

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Fixed income securities 226,381 1,688,166 226,381 1,688,166

226,381 1,688,166 226,381 1,688,166

(33,403,225) 55,051,078 (32,832,665) 54,968,917

12 Net foreign exchange income/(loss)

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Foreign exchange trading income (net) 120,262,351 8,844,295 116,147,446 5,232,111

Unrealised foreign exchange loss on revaluation (12,330,254) (5,246,704) (12,526,107) (5,326,545)

107,932,097 3,597,591 103,621,339 (94,434)

Foreign exchange trading income includes realised gains on derivatives that matured during the year.

Access BAnk Plc 295

Annual Report & Accounts 2017