Page 299 - ACCESS BANK ANNUAL REPORTS_eBook

P. 299

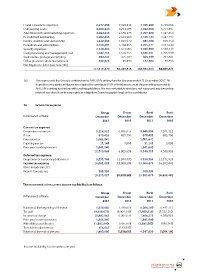

IT and e-business expenses 8,277,398 7,626,411 7,305,290 6,750,086

Outsourcing costs 6,038,146 4,211,075 4,812,368 3,771,607

Advertisements and marketing expenses 2,424,516 1,639,273 2,207,928 1,342,458

Recruitment and training 5,462,666 2,618,909 4,106,144 2,447,297

Events, charities and sponsorship 1,142,566 1,007,974 984,488 869,154

Periodicals and subscriptions 3,518,297 3,104,455 3,201,277 2,691,644

Security expenses 2,148,653 1,671,083 1,846,990 1,548,319

Cash processing and management cost 1,532,751 1,576,253 1,330,451 1,205,990

Stationeries, postage and printing 694,447 475,289 303,389 297,801

Office provisions and entertainment 152,923 49,496 152,924 49,496

Net litigations claims (see note 34(i)

117,119,230 94,413,516 103,993,256 84,588,227

(a) This represents the Group’s contribution to AMCON’s sinking fund for the year ended 31 December 2017. All

deposit money banks in Nigeria are required to contribute 0.5% of total assets as at the preceding year end to

AMCON’s sinking fund in line with existing guidelines. It is non-refundable and does not represent any ownership

interest nor does it confer any rights or obligations (save to pay the levy) on the contributor.

16 Income tax expense

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Current tax expense

Corporate income tax 9,124,532 6,096,035 5,640,954 3,571,312

IT tax 670,435 805,796 670,435 805,796

Education tax 1,081,841 - 1,081,841 -

Capital gains tax 11,145 3,808 11,145 3,808

Prior year’s under provision 1,841,940 - 1,841,940 -

12,729,883 6,905,639 9,246,315 4,380,916

Deferred tax expense

Origination of temporary differences 5,351,746 11,994,470 4,558,364 12,172,525

Income tax expense 18,081,628 18,900,109 13,804,679 16,553,441

Items included in OCI

Income tax expense 188,399 - 188,399 -

18,270,027 18,900,109 13,993,078 16,553,441

The movement in the current income tax liability is as follows:

Group Group Bank Bank

In thousands of Naira December December December December

2017 2016 2017 2016

Balance at the beginning of the year 5,938,662 7,780,824 5,004,160 6,442,311

Tax paid (9,458,675) (8,007,140) (7,860,615) (5,222,302)

Income tax charge 10,887,942 6,905,639 7,404,375 4,380,916

Prior year’s under provision 1,841,940 - 1,841,940 -

Witholding tax utilisation (1,841,940) (596,764) (1,841,940) (596,765)

Translation adjustments 121,655 (143,897) - -

Balance at the end of the year 7,489,586 5,938,662 4,547,920 5,004,160

Income tax liability is to be within one year

Access BAnk Plc 299

Annual Report & Accounts 2017