Page 148 - RFHL ANNUAL REPORT 2024_ONLINE

P. 148

146 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

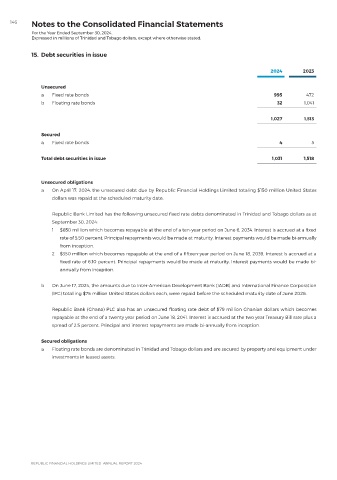

15. Debt securities in issue

2024 2023

Unsecured

a Fixed rate bonds 995 472

b Floating rate bonds 32 1,041

1,027 1,513

Secured

a Fixed rate bonds 4 5

Total debt securities in issue 1,031 1,518

Unsecured obligations

a On April 17, 2024, the unsecured debt due by Republic Financial Holdings Limited totaling $150 million United States

dollars was repaid at the scheduled maturity date.

Republic Bank Limited has the following unsecured fixed rate debts denominated in Trinidad and Tobago dollars as at

September 30, 2024:

1 $650 million which becomes repayable at the end of a ten-year period on June 6, 2034. Interest is accrued at a fixed

rate of 5.50 percent. Principal repayments would be made at maturity. Interest payments would be made bi-annually

from inception.

2 $350 million which becomes repayable at the end of a fifteen-year period on June 18, 2039. Interest is accrued at a

fixed rate of 6.10 percent. Principal repayments would be made at maturity. Interest payments would be made bi-

annually from inception.

b On June 17, 2024, the amounts due to Inter-American Development Bank (IADB) and International Finance Corporation

(IFC) totalling $75 million United States dollars each, were repaid before the scheduled maturity date of June 2026.

Republic Bank (Ghana) PLC also has an unsecured floating rate debt of $79 million Ghanian dollars which becomes

repayable at the end of a twenty year period on June 18, 2041. Interest is accrued at the two year Treasury Bill rate plus a

spread of 2.5 percent. Principal and interest repayments are made bi-annually from inception.

Secured obligations

a Floating rate bonds are denominated in Trinidad and Tobago dollars and are secured by property and equipment under

investments in leased assets.