Page 146 - RFHL ANNUAL REPORT 2024_ONLINE

P. 146

144 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

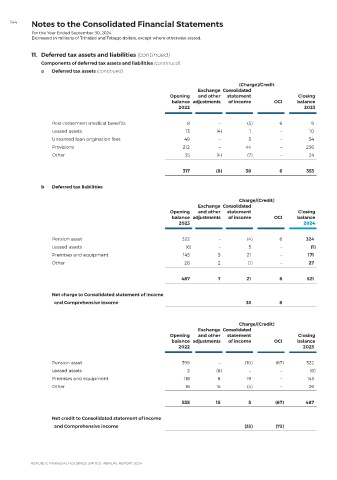

11. Deferred tax assets and liabilities (continued)

Components of deferred tax assets and liabilities (continued)

a Deferred tax assets (continued)

(Charge)/Credit

Exchange Consolidated

Opening and other statement Closing

balance adjustments of income OCI balance

2022 2023

Post-retirement medical benefits 8 – (5) 6 9

Leased assets 13 (4) 1 – 10

Unearned loan origination fees 49 – 5 – 54

Provisions 212 – 44 – 256

Other 35 (4) (7) – 24

317 (8) 38 6 353

b Deferred tax liabilities

Charge/(Credit)

Exchange Consolidated

Opening and other statement Closing

balance adjustments of income OCI balance

2023 2024

Pension asset 322 – (4) 6 324

Leased assets (6) – 5 – (1)

Premises and equipment 145 5 21 – 171

Other 26 2 (1) – 27

487 7 21 6 521

Net charge to Consolidated statement of income

and Comprehensive income 33 8

Charge/(Credit)

Exchange Consolidated

Opening and other statement Closing

balance adjustments of income OCI balance

2022 2023

Pension asset 399 – (10) (67) 322

Leased assets 2 (8) – – (6)

Premises and equipment 118 8 19 – 145

Other 16 15 (4) – 26

535 15 5 (67) 487

Net credit to Consolidated statement of income

and Comprehensive income (33) (73)