Page 142 - RFHL ANNUAL REPORT 2024_ONLINE

P. 142

140 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

10. Employee benefits (continued)

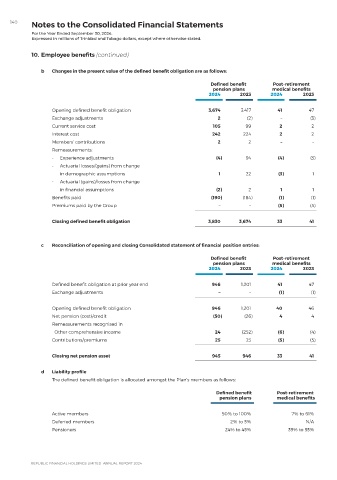

b Changes in the present value of the defined benefit obligation are as follows:

Defined benefit Post-retirement

pension plans medical benefits

2024 2023 2024 2023

Opening defined benefit obligation 3,674 3,417 41 47

Exchange adjustments 2 (2) – (3)

Current service cost 105 99 2 2

Interest cost 242 224 2 2

Members’ contributions 2 2 – –

Remeasurements:

- Experience adjustments (4) 94 (4) (3)

- Actuarial losses/(gains) from change

in demographic assumptions 1 22 (3) 1

- Actuarial (gains)/losses from change

in financial assumptions (2) 2 1 1

Benefits paid (190) (184) (1) (1)

Premiums paid by the Group – – (5) (5)

Closing defined benefit obligation 3,830 3,674 33 41

c Reconciliation of opening and closing Consolidated statement of financial position entries:

Defined benefit Post-retirement

pension plans medical benefits

2024 2023 2024 2023

Defined benefit obligation at prior year end 946 1,201 41 47

Exchange adjustments – – (1) (1)

Opening defined benefit obligation 946 1,201 40 46

Net pension (cost)/credit (50) (26) 4 4

Remeasurements recognised in

Other comprehensive income 24 (252) (6) (4)

Contributions/premiums 25 23 (5) (5)

Closing net pension asset 945 946 33 41

d Liability profile

The defined benefit obligation is allocated amongst the Plan’s members as follows:

Defined benefit Post-retirement

pension plans medical benefits

Active members 50% to 100% 7% to 61%

Deferred members 2% to 5% N/A

Pensioners 24% to 45% 39% to 93%