Page 140 - RFHL ANNUAL REPORT 2024_ONLINE

P. 140

138 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

9. Intangible assets (continued)

a Goodwill (continued)

Impairment testing of goodwill (continued)

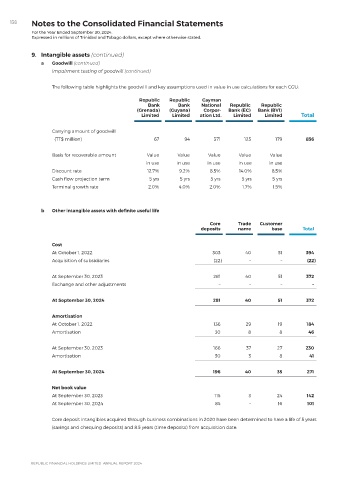

The following table highlights the goodwill and key assumptions used in value in use calculations for each CGU:

Republic Republic Cayman

Bank Bank National Republic Republic

(Grenada) (Guyana) Corpor- Bank (EC) Bank (BVI)

Limited Limited ation Ltd. Limited Limited Total

Carrying amount of goodwill

(TT$ million) 67 94 371 125 179 836

Basis for recoverable amount Value Value Value Value Value

in use in use in use in use in use

Discount rate 12.7% 9.2% 8.5% 14.0% 8.5%

Cash flow projection term 5 yrs 5 yrs 5 yrs 5 yrs 5 yrs

Terminal growth rate 2.0% 4.0% 2.0% 1.7% 1.5%

b Other intangible assets with definite useful life

Core Trade Customer

deposits name base Total

Cost

At October 1, 2022 303 40 51 394

Acquisition of subsidiaries (22) – – (22)

At September 30, 2023 281 40 51 372

Exchange and other adjustments – – – –

At September 30, 2024 281 40 51 372

Amortisation

At October 1, 2022 136 29 19 184

Amortisation 30 8 8 46

At September 30, 2023 166 37 27 230

Amortisation 30 3 8 41

At September 30, 2024 196 40 35 271

Net book value

At September 30, 2023 115 3 24 142

At September 30, 2024 85 – 16 101

Core deposit intangibles acquired through business combinations in 2020 have been determined to have a life of 5 years

(savings and chequing deposits) and 8.5 years (time deposits) from acquisition date.