Page 141 - RFHL ANNUAL REPORT 2024_ONLINE

P. 141

139

9. Intangible assets (continued)

b Other intangible assets with definite useful life (continued)

Trade name intangibles acquired through business combinations in 2019 have been determined to have a life of 5 years

from acquisition date and therefore was fully amortised in the current financial year.

Customer base intangibles acquired through business combinations in 2020 have been determined to have a life of 6.2

years from acquisition date.

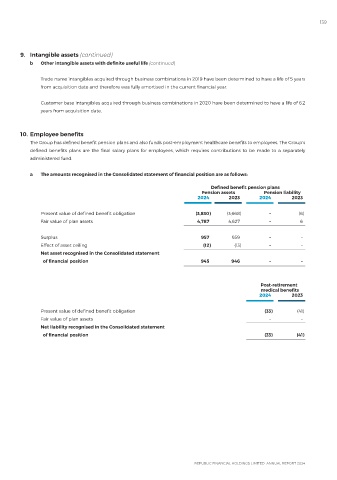

10. Employee benefits

The Group has defined benefit pension plans and also funds post-employment healthcare benefits to employees. The Group’s

defined benefits plans are the final salary plans for employees, which requires contributions to be made to a separately

administered fund.

a The amounts recognised in the Consolidated statement of financial position are as follows:

Defined benefit pension plans

Pension assets Pension liability

2024 2023 2024 2023

Present value of defined benefit obligation (3,830) (3,668) – (6)

Fair value of plan assets 4,787 4,627 – 6

Surplus 957 959 – –

Effect of asset ceiling (12) (13) – –

Net asset recognised in the Consolidated statement

of financial position 945 946 – –

Post-retirement

medical benefits

2024 2023

Present value of defined benefit obligation (33) (41)

Fair value of plan assets – –

Net liability recognised in the Consolidated statement

of financial position (33) (41)