Page 139 - RFHL ANNUAL REPORT 2024_ONLINE

P. 139

137

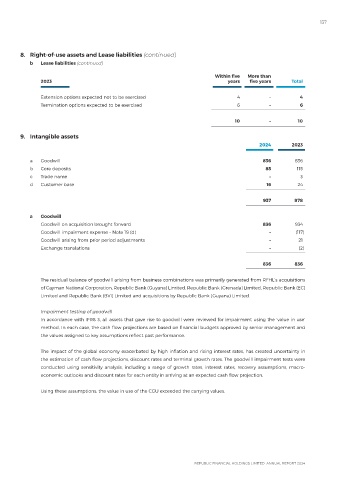

8. Right-of-use assets and Lease liabilities (continued)

b Lease liabilities (continued)

Within five More than

2023 years five years Total

Extension options expected not to be exercised 4 – 4

Termination options expected to be exercised 6 – 6

10 – 10

9. Intangible assets

2024 2023

a Goodwill 836 836

b Core deposits 85 115

c Trade name – 3

d Customer base 16 24

937 978

a Goodwill

Goodwill on acquisition brought forward 836 934

Goodwill impairment expense – Note 19 (d) – (117)

Goodwill arising from prior period adjustments – 21

Exchange translations – (2)

836 836

The residual balance of goodwill arising from business combinations was primarily generated from RFHL’s acquisitions

of Cayman National Corporation, Republic Bank (Guyana) Limited, Republic Bank (Grenada) Limited, Republic Bank (EC)

Limited and Republic Bank (BVI) Limited and acquisitions by Republic Bank (Guyana) Limited.

Impairment testing of goodwill

In accordance with IFRS 3, all assets that gave rise to goodwill were reviewed for impairment using the ‘value in use’

method. In each case, the cash flow projections are based on financial budgets approved by senior management and

the values assigned to key assumptions reflect past performance.

The impact of the global economy exacerbated by high inflation and rising interest rates, has created uncertainty in

the estimation of cash flow projections, discount rates and terminal growth rates. The goodwill impairment tests were

conducted using sensitivity analysis, including a range of growth rates, interest rates, recovery assumptions, macro-

economic outlooks and discount rates for each entity in arriving at an expected cash flow projection.

Using these assumptions, the value in use of the CGU exceeded the carrying values.