Page 143 - RFHL ANNUAL REPORT 2024_ONLINE

P. 143

141

10. Employee benefits (continued)

d Liability profile (continued)

The weighted duration of the defined benefit obligation ranged from 12.19 to 16.22 years.

29 percent to 78 percent of the defined benefit obligation for active members was conditional on future salary increases.

67 percent to 100 percent of the benefits for active members were vested.

There are no asset-liability matching strategies used by the Plans.

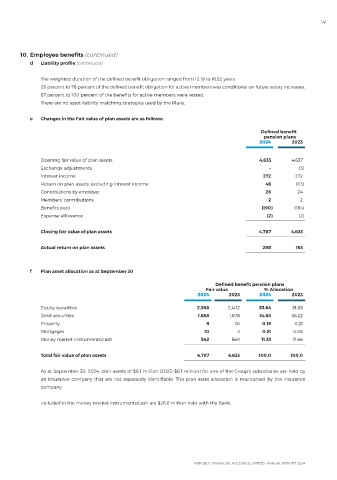

e Changes in the Fair value of plan assets are as follows:

Defined benefit

pension plans

2024 2023

Opening fair value of plan assets 4,633 4,637

Exchange adjustments – (3)

Interest income 272 272

Return on plan assets, excluding interest income 46 (113)

Contributions by employer 26 24

Members’ contributions 2 2

Benefits paid (190) (184)

Expense allowance (2) (2)

Closing fair value of plan assets 4,787 4,633

Actual return on plan assets 298 153

f Plan asset allocation as at September 30

Defined benefit pension plans

Fair value % Allocation

2024 2023 2024 2023

Equity securities 2,568 2,402 53.64 51.85

Debt securities 1,658 1,678 34.63 36.22

Property 9 10 0.19 0.21

Mortgages 10 3 0.21 0.06

Money market instruments/cash 542 540 11.33 11.66

Total fair value of plan assets 4,787 4,633 100.0 100.0

As at September 30, 2024, plan assets of $6.1 million (2023: $6.1 million) for one of the Group’s subsidiaries are held by

an insurance company that are not separately identifiable. This plan asset allocation is maintained by the insurance

company.

Included in the money market instruments/cash are $26.6 million held with the Bank.