Page 84 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 84

82 • Republic Financial Holdings Limited 2025 Annual Report • SUSTAINABILITY

Pioneering Progress

RFHL’s Path to Regional and Global Impact

Republic Financial Holdings Limited (RFHL) has made

significant strides in embedding sustainability into the Sustainability is now firmly embedded

core of our business strategy over the last fiscal year. In the into the core of the Group’s strategic

last three years, we have transitioned from establishing the decision-making and risk management

foundational Environmental, Social and Governance (ESG)

architecture.

framework to executing high-impact initiatives that are

shaping a more sustainable future for the region. This new era

of sustainable governance and accountability has culminated

in RFHL’s publication of the first dedicated Sustainability

Report. The document immediately cemented a regional The Group successfully generated tangible financial and

leadership position and established standard for transparent economic value through the execution of our climate finance

disclosure across all 16 subsidiaries. By anchoring the mandate. Our transition financing strategy saw the catalytic

comprehensive framework to global standards, including the completion of 93 percent of the USD 200 million Climate

United Nations Environment Programme Finance Initiative Finance Fund target as at end of September 2025, actively

(UNEP FI) Principles for Responsible Banking (PRB) and the building regional climate resilience. In parallel, the Group’s

Net-Zero Banking Alliance (NZBA), and establishing Board- Micro, Small and Medium Enterprise (MSME) Loan Facility

level oversight, sustainability is now firmly embedded into continued to advance financial inclusion and entrepreneurial

the core of the Group’s strategic decision-making and risk growth, disbursing TTD 118.28 million to 1,566 MSMEs, with 46

management architecture. percent of financing reaching women-led enterprises. Beyond

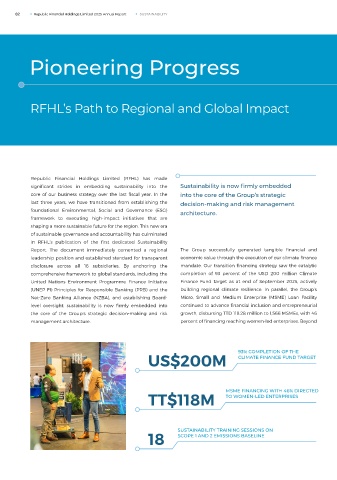

93% COMPLETION OF THE

US$200M CLIMATE FINANCE FUND TARGET

MSME FINANCING WITH 46% DIRECTED

TT$118M TO WOMEN-LED ENTERPRISES

SUSTAINABILITY TRAINING SESSIONS ON

18 SCOPE 1 AND 2 EMISSIONS BASELINE