Page 55 - Real Estate One - Marketing Support

P. 55

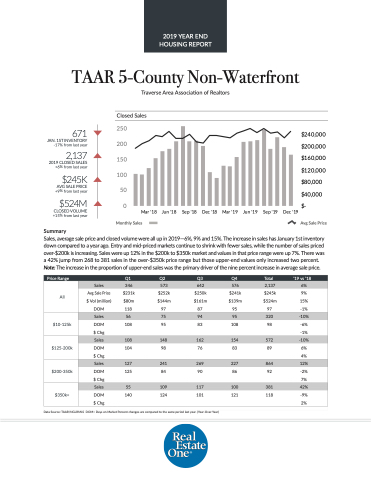

TAAR 5-County Non-Waterfront

Traverse Area Association of Realtors Closed Sales

671

JAN. 1ST INVENTORY -17% from last year

2,137

2019 CLOSED SALES +6% from last year

$245K

AVG SALE PRICE +9% from last year

$524M

CLOSED VOLUME +15% from last year

Summary

Avg Sale Price

250

200

150

100

50 0

Mar '18

Jun '18

Sep '18

Dec '18

Mar '19

Jun '19

Sep '19

Dec '19

$240,000 $200,000 $160,000 $120,000 $80,000 $40,000 $-

Monthly Sales

Sales, average sale price and closed volume were all up in 2019—6%, 9% and 15%. The increase in sales has January 1st inventory down compared to a year ago. Entry and mid-priced markets continue to shrink with fewer sales, while the number of sales priced over-$200k is increasing. Sales were up 12% in the $200k to $350k market and values in that price range were up 7%. There was a 42% jump from 268 to 381 sales in the over-$350k price range but those upper-end values only increased two percent. Note: The increase in the proportion of upper-end sales was the primary driver of the nine percent increase in average sale price.

e Price Range

Q1

Q2

Q3

Q4

Total

‘19 vs ‘18

All

Sales

346

573

642

576

2,137

6%

Avg Sale Price

$231k

$252k

$250k

$241k

$245k

9%

$ Vol (million)

$80m

$144m

$161m

$139m

$524m

15%

DOM

118

97

87

95

97

-1%

$10-125k

Sales

56

75

94

95

320

-10%

DOM

108

95

83

108

98

-6%

$ Chg

-1%

$125-200k

Sales

108

148

162

154

572

-10%

DOM

104

98

76

83

89

6%

$ Chg

4%

$200-350k

Sales

127

241

269

227

864

12%

DOM

125

84

90

86

92

-2%

$ Chg

7%

$350k+

Sales

55

109

117

100

381

42%

DOM

140

124

101

121

118

-9%

$ Chg

2%

Data Source: TAAR/NGLRMLS DOM= Days on Market Percent changes are compared to the same period last year. (Year-Over-Year)

2019 YEAR END HOUSING REPORT