Page 30 - Kiplinger's Personal Finance - November 2018

P. 30

INVESTING

slowdown in China, a driver of global are underrepresented in your portfo- emerging-markets stocks, Kass had

growth since the financial crisis, would lio, consider gradually shifting some expected 2018 to be underwhelming

particularly hurt emerging markets. of the assets tied to your biggest U.S. and volatile, and it has been—although

Investors should fight the tendency stock winners to foreign shares. It’s perhaps more than he had anticipated.

to approach the developing world as a a simple sell-high, buy-low strategy. But, he says, “We are beginning to see

single asset class, says Andrey Kutu- (For more on rebalancing, see “What’s value and opportunity in certain coun-

zov, a portfolio manager at Wasatch Your Next Move?” on page 48.) tries, such as Brazil, Mexico, Indone-

Advisors. “It’s really a collection of dif- Index fans can choose a low-cost sia and Thailand.” Over the past five

ferent countries with little in common.” portfolio, such as SCHWAB EMERGING MAR- years, Kass has outpaced the MSCI

KETS EQUITY ETF (SYMBOL SCHE, 0.13% EX- EM index by an average of one per-

What to do now. Expect continued vola- PENSE RATIO), ISHARES CORE MSCI EMERGING centage point per year.

tility and possibly more losses. But MARKETS ETF (IEMG, 0.14%) or VANGUARD

for investors with five- to 10-year time FTSE EMERGING MARKETS ETF (VWO, 0.14%). E AMERICAN FUNDS NEW WORLD (NWFFX).

horizons who can stay the course, this But navigating emerging markets will This fund is a good choice for investors

could be a good buying opportunity, be tricky in the near term, and if you in search of a way into emerging mar-

says Jim Paulsen, chief investment go the index-fund route, at least pair kets that offers a little less volatility.

strategist at the Leuthold Group. it with a good actively managed fund. About half of the fund is invested in

Shares in emerging markets trade at You’ll want a pro who can focus on emerging-markets stocks; the other

11 times expected earnings for 2019. the better-positioned countries, such half is invested in big developed-coun-

In the U.S., by contrast, stocks trade as South Korea, Taiwan, India and try multinationals that have signifi-

at 17 times expected earnings. And China, while also snapping up bargains cant sales or assets in emerging

though growth has slowed, many that have been unfairly punished in markets. “It’s a global approach to in-

emerging economies are still expanding troubled nations. The funds below are vesting in emerging markets,” says

at healthy rates. On average, analysts worthy choices. David Polak, an investment director

expect more than 5% GDP growth in with the fund. “To cash in on Chinese

emerging countries in each of the next E BARON EMERGING MARKETS (BEXFX). This consumers who are buying luxury

three calendar years, beating the 1.7% fund—a member of the Kiplinger 25, goods, you have to invest in European

to 2.2% annual rate expected for de- the list of our favorite no-load funds— companies. But if you want to invest in

veloped countries. doesn’t own any stocks in Turkey. the growth of the internet in China,

The long bull market in U.S. stocks Instead, manager Michael Kass has you buy shares in Chinese companies.”

has left investors with a “too U.S.– invested more than half of the fund’s The fund’s five-year annualized return

centric investment mindset,” says assets in China, India and South Ko- of 4.4% beats the MSCI EM index,

Paulsen. If emerging-markets stocks rea. At the end of 2017, a good year for with more than 25% less volatility.

E MATTHEWS ASIA INNOVATORS (MATFX). In

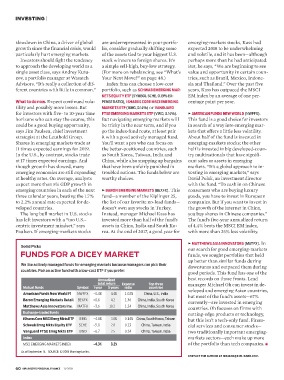

Solid Picks

our search for good emerging-markets

FUNDS FOR A DICEY MARKET funds, we sought portfolios that held

up better than similar funds during

We like actively managed funds for emerging markets because managers can pick their

downturns and outpaced them during

countries. Pair an active fund with a low-cost ETF if you prefer.

good periods. This fund has one of the

Annualized best records on those fronts. Lead

total return Expense Top three manager Michael Oh can invest in de-

Mutual funds Symbol 1 year 5 years ratio countries

veloped and emerging Asian countries,

American Funds New World F1 NWFFX –0.4% 4.4% 1.02% China, U.S., India

but most of the fund’s assets—67%

Baron Emerging Markets Retail BEXFX –8.6 4.2 1.36 China, India, South Korea

currently—are invested in emerging

Matthews Asia Innovators Inv. MATFX 10.2 China, India, South Korea

countries. Oh focuses on firms with

1.24

–3.6

Exchange-traded funds

cutting-edge products or technology,

iShares Core MSCI Emrg Mkts ETF IEMG –4.8% 3.0% 0.14% China, South Korea, Taiwan but this isn’t a tech-only fund. Finan-

Schwab Emrg Mkts Equity ETF SCHE –5.8 2.8 0.13 China, Taiwan, India cial services and consumer stocks—

Vanguard FTSE Emrg Mkts ETF VWO –6.7 2.5 0.14 China, Taiwan, India two traditionally important emerging-

Index markets sectors—each make up more

MSCI EMERGING MARKETS INDEX –4.3% 3.2% of the portfolio than tech companies.

As of September 14. SOURCE: © 2018 Morningstar Inc.

CONTACT THE AUTHOR AT NHUANG@KIPLINGER.COM.

60 KIPLINGER’S PERSONAL FINANCE 11/2018

K11I-EMERGING MARKETS.indd 60 9/20/18 12:04 PM