Page 4 - IPO Analysis - Private Equity Exits 2017_Final

P. 4

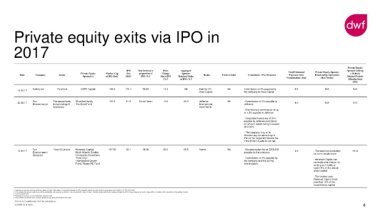

Private equity exits via IPO in

2017

Private Equity

IPO Sell Down as a Price Aggregate Total Estimated Private Equity Sponsor Sponsor lock-up

Private Equity Market Cap Size proportion of Change Sponsor + Orderly

Date Company Sector Banks Underwritten Commission / Fee Structure Expenses (incl. Relationship Agreement

Sponsor(s) at IPO (£m) 1 (£M) 2 IPO (%) 3 Since IPO Retained Stake Market Periods

(%) 4 at IPO (%) 5 Commissions) (£m) (Key Terms) (Months from

IPO)

Xafinity plc Financial CBPE Capital 190.3 171.1 56.93 11.0 Nil Deloitte CF, No Commission of 2% payable by 8.5 N/A N/A

16.02.17

Zeus Capital the company to Zeus Capital

Arix Pharmaceuticals, Woodford funds, 187.0 91.0 No sell down -3.0 20.0 Jefferies No - Commission of 3% payable to

22.02.17 9.0 N/A 6+0

Bioscience plc biotechnology & The Elcot Fund International, Jefferies

healthcare Scott Harris

- Discretionary commission of up

to 1.5% payable to Jefferies

- Corporate finance fee of £1m

payable to Jefferies conditional

on amount raised being in excess

of £100m.

- The company may at its

direction pay an amount up to

£1m of the corporate finance fee

if the £100m hurdle is not met.

Ten Travel & Leisure Harwood Capital, 107.25 26.1 38.99 56.0 69.5 Numis No - Documentation fee of £250,000

19.04.17 3.2 - Transactions conducted 12+6

Entertainment North Atlantic Smaller payable by the company on arm's length terms

Group plc Companies Investment

Trust, Oryx - Commission of 2% payable by - Harwood Capital can

International Growth the company and the selling

Fund, Trident PE Fund shareholders nominate one director for

so long as it holds at

least 10% of the issued

share capital

- Terminates once

Harwood Capital holds

less than 10% of the

issued share capital

1. Assuming no exercise of an over-allotment option (if any). Such option, if exercised following the IPO, typically involves the sale of shares representing up to a further 10-15% of the offer.

2. This includes the amount raised by any selling shareholders and assumes no exercise of an over-allotment option (if any). Note that funds raised by the company through the IPO in many instances are used to repay debt or to redeem other instruments in the capital structure.

3. As at 5 January 2018.

4. Assuming no exercise of an over-allotment option (if any).

5. This includes an estimate of the expenses payable by any selling shareholders (if known).

Private & Confidential. Not for distribution.

© DWF LLP 2018 4