Page 5 - IPO Analysis - Private Equity Exits 2017_Final

P. 5

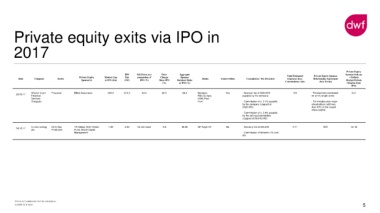

Private equity exits via IPO in

2017

Private Equity

IPO Sell Down as a Price Aggregate Total Estimated Private Equity Sponsor Sponsor lock-up

Private Equity Market Cap Size proportion of Change Sponsor + Orderly

Date Company Sector Banks Underwritten Commission / Fee Structure Expenses (incl. Relationship Agreement

Sponsor(s) at IPO (£m) (£M) IPO (%) Since IPO Retained Stake Market Periods

(%) at IPO (%) Commissions) (£m) (Key Terms) (Months from

IPO)

Charter Court Financial Elliott Associates 550.0 210.0 83.3 23.0 54.0 Barclays, Yes - Sponsor fee of £250,000 9.9 - Transactions conducted 6+0

29.09.17

Financial RBC Europe, payable by the company on arm's length terms

Services KBW, Peel

Group plc Hunt - Commission of c. 3.1% payable - Terminates once major

by the company (capped at shareholders hold less

£625,000) than 30% of the issued

share capital

- Commission of c. 3.4% payable

by the selling shareholders

(capped at £6,845,000)

Curzon Energy Oil & Gas YA Global, GSC Global 7.26 2.33 No sell down -6.0 48.68 SP Angel CF No - Advisory fee of £25,000 0.71 N/A 12+12

04.10.17

plc Producers Fund, Shard Capital

Management - Commission of between 1% and

6%

Private & Confidential. Not for distribution.

© DWF LLP 2018 5