Page 6 - IPO Analysis - Private Equity Exits 2017_Final

P. 6

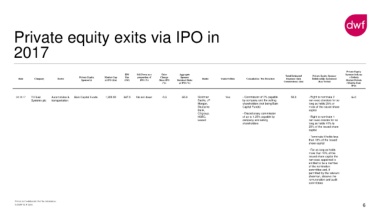

Private equity exits via IPO in

2017

Private Equity

IPO Sell Down as a Price Aggregate Total Estimated Private Equity Sponsor Sponsor lock-up

Private Equity Market Cap Size proportion of Change Sponsor + Orderly

Date Company Sector Banks Underwritten Commission / Fee Structure Expenses (incl. Relationship Agreement

Sponsor(s) at IPO (£m) (£M) IPO (%) Since IPO Retained Stake Market Periods

(%) at IPO (%) Commissions) (£m) (Key Terms) (Months from

IPO)

30.10.17 TI Fluid Automobiles & Bain Capital Funds 1,300.00 347.0 No sell down -0.3 65.9 Goldman Yes - Commission of 2% payable 58.0 - Right to nominate 2 6+0

Systems plc transportation Sachs, JP by company and the selling non-exec directors for so

Morgan, shareholders (not being Bain long as holds 25% or

Deutsche Capital Funds) more of the issued share

Bank, capital

Citigroup, - Discretionary commission

HSBC, of up to 1.25% payable by - Right to nominate 1

Lazard company and selling non exec director for so

shareholders long as holds 10% to

25% of the issued share

capital

- Terminate if holds less

than 10% of the issued

share capital

- For as long as holds

more than 10% of the

issued share capital the

non-exec appointed is

entitled to be a member

of the nomination

committee and, if

permitted by the relevant

chairman, observe the

remuneration and audit

committees

Private & Confidential. Not for distribution.

© DWF LLP 2018 6