Page 8 - IPO Analysis - Private Equity Exits 2017_Final

P. 8

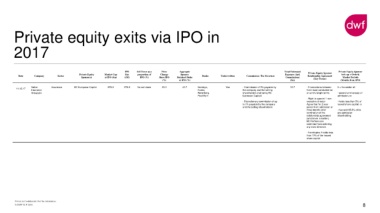

Private equity exits via IPO in

2017

IPO Sell Down as a Price Aggregate Total Estimated Private Equity Sponsor

Private Equity Market Cap Size proportion of Change Sponsor Expenses (incl. Private Equity Sponsor lock-up + Orderly

Date Company Sector Banks Underwritten Commission / Fee Structure Relationship Agreement

Sponsor(s) at IPO (£m) (£M) IPO (%) Since IPO Retained Stake Commissions) (Key Terms) Market Periods

(%) at IPO (%) (£m) (Months from IPO)

Sabre Insurance BC European Capital 575.0 278.8 No sell down 23.0 42.7 Barclays, Yes - Commission of 2% payable by 12.7 - Transactions between 6 + the earlier of:

11.12.17

Insurance Numis, the company and the selling them must conducted be

Group plc Berenberg, shareholders (not being BC on arm's length terms - second anniversary of

Peel Hunt European Capital) admission, or

- Right to appoint 1 non-

- Discretionary commission of up executive director - holds less than 5% of

to 1% payable by the company Agree that for 2 year issued share capital, or

and the selling shareholders period from admission or

three months after - has sold 85.5% of its

termination of the pre-admission

relationship agreement shareholding

(whichever is earlier),

BC Partners are

restricted from soliciting

any exec directors

- Terminates if holds less

than 10% of the issued

share capital

Private & Confidential. Not for distribution.

© DWF LLP 2018 8