Page 332 - rise 2017

P. 332

accounts. It is advantageous for Islamic banking to maintain a long-term relationship with their

customers.

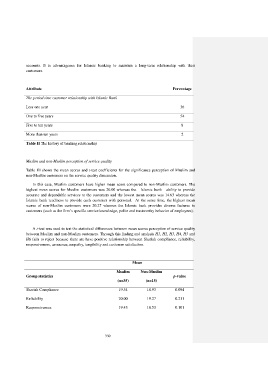

Attribute Percentage

The period time customer relationship with Islamic Bank

Less one year 36

One to five years 54

Five to ten years 8

More than ten years 2

Table II The history of banking relationship

Muslim and non-Muslim perception of service quality

Table III shows the mean scores and t-test coefficients for the significance perception of Muslim and

non-Muslim customers on the service quality dimension.

In this case, Muslim customers have higher mean score compared to non-Muslim customers. The

highest mean scores for Muslim customers was 20.00 whereas the Islamic bank ability to provide

accurate and dependable services to the customers and the lowest mean scores was 14.63 whereas the

Islamic bank readiness to provide each customer with personal. At the same time, the highest mean

scores of non-Muslim customers were 20.27 whereas the Islamic bank provides diverse features to

customers (such as the firm’s specific service knowledge, polite and trustworthy behavior of employees).

A t-test was used to test the statistical differences between mean scores perception of service quality

between Muslim and non-Muslim customers. Through this finding and analysis H1, H2, H3, H4, H5 and

H6 fails to reject because there are have positive relationship between Shariah compliance, reliability,

responsiveness, assurance, empathy, tangibility and customer satisfaction.

Mean

Muslim Non-Muslim

Group statistics p-value

(n=35) (n=15)

Shariah Compliance 19.54 18.93 0.094

Reliability 20.00 19.27 0.211

Responsiveness 19.43 18.53 0.101

330