Page 5 - Q2 GI/J&J Newsletter, 2019

P. 5

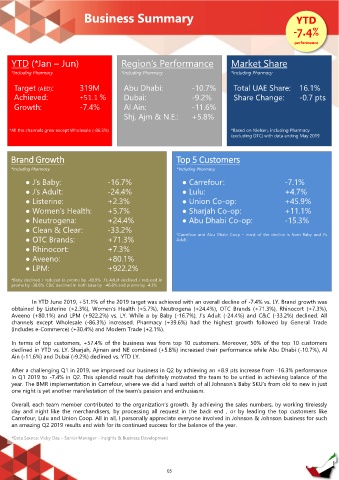

Business Summary YTD

-7.4%

performance

YTD (*Jan – Jun) Region’s Performance Market Share

*Including Pharmacy *Including Pharmacy *Including Pharmacy

Target (AED): 319M Abu Dhabi: -10.7% Total UAE Share: 16.1%

Achieved: +51.1 % Dubai: -9.2% Share Change: -0.7 pts

Growth: -7.4% Al Ain: -11.6%

Shj, Ajm & N.E.: +5.8%

*All the channels grew except Wholesale (-86.3%) *Based on Nielsen, including Pharmacy

(excluding OTC) with data ending May 2019

Brand Growth Top 5 Customers

*Including Pharmacy *Including Pharmacy

● J’s Baby: -16.7% ● Carrefour : -7.1%

● J’s Adult: -24.4% ● Lulu: +4.7%

● Listerine: +2.3% ● Union Co-op: +45.9%

● Women’s Health: +5.7% ● Sharjah Co-op: +11.1%

● Neutrogena: +24.4% ● Abu Dhabi Co-op: -15.3%

● Clean & Clear: -33.2%

● OTC Brands: +71.3% *Carrefour and Abu Dhabi Coop – most of the decline is from Baby and J’s

Adult.

● Rhinocort: +7.3%

● Aveeno: +80.1%

● LPM: +922.2%

*Baby declined / reduced in promo by -49.9%. J’s Adult declined / reduced in

promo by -38.6%. C&C declined in both base by -46.6% and promo by -4.3%

In YTD June 2019, +51.1% of the 2019 target was achieved with an overall decline of -7.4% vs. LY. Brand growth was

obtained by Listerine (+2.3%), Women’s Health (+5.7%), Neutrogena (+24.4%), OTC Brands (+71.3%), Rhinocort (+7.3%),

Aveeno (+80.1%) and LPM (+922.2%) vs. LY. While a by Baby (-16.7%), J’s Adult (-24.4%) and C&C (-33.2%) declined. All

channels except Wholesale (-86.3%) increased. Pharmacy (+39.6%) had the highest growth followed by General Trade

(includes e-Commerce) (+30.4%) and Modern Trade (+2.1%).

In terms of top customers, +57.4% of the business was from top 10 customers. Moreover, 50% of the top 10 customers

declined in YTD vs. LY. Sharjah, Ajman and NE combined (+5.8%) increased their performance while Abu Dhabi (-10.7%), Al

Ain (-11.6%) and Dubai (-9.2%) declined vs. YTD LY.

After a challenging Q1 in 2019, we improved our business in Q2 by achieving an +8.9 pts increase from -16.3% performance

in Q1 2019 to -7.4% in Q2. This splendid result has definitely motivated the team to be untied in achieving balance of the

year. The BMR implementation in Carrefour, where we did a hard switch of all Johnson’s Baby SKU’s from old to new in just

one night is yet another manifestation of the team’s passion and enthusiasm.

Overall, each team member contributed to the organization’s growth. By achieving the sales numbers, by working tirelessly

day and night like the merchandisers, by processing all request in the back end , or by leading the top customers like

Carrefour, Lulu and Union Coop. All in all, I personally appreciate everyone involved in Johnson & Johnson business for such

an amazing Q2 2019 results and wish for its continued success for the balance of the year.

*Data Source: Vicky Das – Senior Manager - Insights & Business Development

05