Page 6 - Walter Robbs 2018 Benefit Guide

P. 6

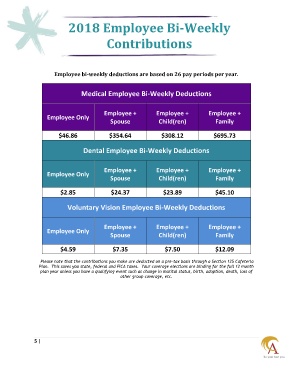

2018 Employee Bi-Weekly

Contributions

Employee bi-weekly deductions are based on 26 pay periods per year.

Medical Employee Bi-Weekly Deductions

Employee + Employee + Employee +

Employee Only

Spouse Child(ren) Family

$46.86 $354.64 $308.12 $695.73

Dental Employee Bi-Weekly Deductions

Employee + Employee + Employee +

Employee Only

Spouse Child(ren) Family

$2.85 $24.37 $23.89 $45.10

Voluntary Vision Employee Bi-Weekly Deductions

Employee + Employee + Employee +

Employee Only

Spouse Child(ren) Family

$4.59 $7.35 $7.50 $12.09

Please note that the contributions you make are deducted on a pre-tax basis through a Section 125 Cafeteria

Plan. This saves you state, federal and FICA taxes. Your coverage elections are binding for the full 12 month

plan year unless you have a qualifying event such as change in marital status, birth, adoption, death, loss of

other group coverage, etc.

5 |