Page 7 - Walter Robbs 2018 Benefit Guide

P. 7

Medical & Prescription Drug Plan

Group # 14151058

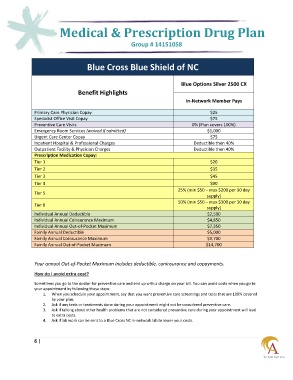

Blue Cross Blue Shield of NC

Blue Options Silver 2500 CX

Benefit Highlights

In-Network Member Pays

Primary Care Physician Copay $25

Specialist Office Visit Copay $75

Preventive Care Visits 0% (Plan covers 100%)

Emergency Room Services (waived if admitted) $1,000

Urgent Care Center Copay $75

Inpatient Hospital & Professional Charges Deductible then 40%

Outpatient Facility & Physician Charges Deductible then 40%

Prescription Medication Copay:

Tier 1 $20

Tier 2 $35

Tier 3 $45

Tier 4 $90

25% (min $50 – max $200 per 30 day

Tier 5

supply)

50% (min $50 – max $300 per 30 day

Tier 6

supply)

Individual Annual Deductible $2,500

Individual Annual Coinsurance Maximum $4,850

Individual Annual Out-of-Pocket Maximum $7,350

Family Annual Deductible $5,000

Family Annual Coinsurance Maximum $9,700

Family Annual Out-of-Pocket Maximum $14,700

Your annual Out-of-Pocket Maximum includes deductible, coninsurance and copayments.

How do I avoid extra cost?

Sometimes you go to the doctor for preventive care and end up with a charge on your bill. You can avoid costs when you go to

your appointment by following these steps:

1. When you schedule your appointment, say that you want preventive care screenings and tests that are 100% covered

by your plan.

2. Ask if any tests or treatments done during your appointment might not be considered preventive care.

3. Ask if talking about other health problems that are not considered preventive care during your appointment will lead

to extra costs.

4. Ask if lab work can be sent to a Blue Cross NC in-network lab to lower your costs.

6 |